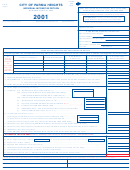

Form Ph Np - Net Profit Tax Return - City Of Parma Heights - 2001 Page 2

ADVERTISEMENT

Page 2

GENERAL TAX INFORMATION - MUST BE COMPLETED

1. Date Business or Trust Created _________________________

6. If business terminated, complete the following; Date terminated

2. Did you file a Parma Heights return last year? ____ Yes ____ No.

3. Did you have any employees during 2001? ____ Yes ____ No. If yes, did

7. If you sold your business, give name and address of purchaser.

they work in Parma Heights? ____ Yes ____ No.

Name

4. On which basis are your records kept? ____ Cash ____ Accrual

Address

____ Completed Contract ____ Other _____________________________

8. If Business Entity changed during past year, mark appropriate blocks:

5. Has your Federal Tax liability for any prior year been changed in the year

From:

_____ Individual

_____ Partnership

_____ Corporation

covered by this return as a result of an examination by the Internal Revenue

To:

_____ Individual

_____ Partnership

_____ Corporation

Service? ____ Yes ____ No.

SCHEDULE G

INCOME FROM RENTS

Complete this Schedule if you are not required to file with the Internal Revenue Service. Otherwise, attach copy of Federal Schedule.

If more than one property involved - Give Complete Breakdown and Address of Each - Jointly Owned Property Must File As One Entity

Eligible Loss

Net Income

Type & address of property, City & State

Amount of Rent

Depreciation

Repairs

Other Expenses

Carry Forward

or Loss

$

$

$

$

$

$

NOTE: LOSS Carry-Forward 5 year limit (See Instructions)

NET INCOME ONLY - Enter on Line 1, Page 1

$

SCHEDULE X

RECONCILIATION WITH FEDERAL INCOME TAX RETURN

TO EXCLUDE INCOME NOT TAXABLE, AND EXPENSES NOT ALLOWABLE

Schedule X entries are allowed only to the extent directly included in determination of net profits as shown on your Federal Return.

ITEMS NOT DEDUCTABLE – ADD

ITEMS NOT TAXABLE – DEDUCT

I. Capital gains (Excluding Ordinary Gains) ....................... $

A. Capital losses (Excluding Ordinary Losses) ................... $

B. Expenses incurred in the production of non-taxable

J. Interest income ...............................................................

income (At least 5% of Line Z) .......................................

K. Dividends ........................................................................

C. Taxes based on income ..................................................

L. Other (explain)

D. Net operating loss carry forward from Federal Return ....

E. Payments to Partners .....................................................

F. Contributions exceeding allowance of 5% ......................

G. Other expenses not deductible (explain) ........................

H. TOTAL ADDITIONS (enter Line 2A, Page 1) .................. $

Z. TOTAL DEDUCTIONS (enter Line 2B, Page 1) .............. $

SCHEDULE Y BUSINESS ALLOCATION FORMULA

a. LOCATED

b. LOCATED IN

PERCENTAGE

EVERYWHERE

PARMA HEIGHTS

[(b) Divided (a)]

STEP 1. AVG. VALUE OF REAL & TANG. PERSONAL PROPERTY

$ _______________

$ _______________

GROSS ANNUAL RENTALS PAID MULTIPLIED BY 8

$ _______________

$ _______________

TOTAL STEP 1

$ _______________

$ _______________

_______________ %

STEP 2. GROSS RECEIPTS FROM SALES MADE AND/OR WORK

OR SERVICES PERFORMED (SEE INSTRUCTIONS)

$ _______________

$ _______________

_______________ %

STEP 3. WAGES, SALARIES, AND OTHER COMPENSATION PAID

$ _______________

$ _______________

_______________ %

STEP 4. TOTAL PERCENTAGES

_______________ %

STEP 5. AVERAGE PERCENTAGE (Divide Total Percentages

by Number of Percentages Used)

Carry to Page 1, Line 4 _______________ %

SCHEDULE Z

PARTNERS’ DISTRIBUTIVE SHARES OF NET INCOME (FROM FEDERAL SCHEDULE 1065K and 1099)

3. Distributive Shares

2. Resident

5. Taxable

6. Amount

4. Other

of Partners

Payments

Percentage

Taxable

Yes

No

Percent

Amount

1. Name and Address of Each Partner

% $

$

% $

% $

$

% $

% $

$

% $

% $

$

% $

100% $

$

$

7. TOTALS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2