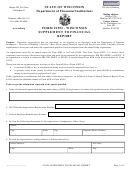

FINANCIAL INFORMATION

Enter the accounting period (month, day, and year) that the following financial information applies to and identify the accounting

method used when preparing the information.

Beginning Date:

Ending Date:

Accounting Method:

Cash

Accrual

Other (specify)

1

1.

Contributions ........................................................................................................................................................

("Contribution" means a grant or pledge of money, credit, property, or other thing of any kind or value, except

used clothing or household goods, to a charitable organization or for a charitable purpose. Bequests received

directly from the public and indirect public support, such as contributions received through solicitation

campaigns conducted by federated fundraising agencies like United Way should be included in this amount.

"Contribution" does not include:

income from bingo or raffles conducted under ch. 563, Wis. Stats.

government grants

bona fide fees, dues, or assessments paid by a member of a charitable organization, except that, if

initial membership in a charitable organization is conferred solely as consideration for making a

grant or pledge of money to the charitable organization in response to a solicitation, that grant or

pledge of money is a contribution.)

2.

Other Revenues ....................................................................................................................................................

2

3.

Total Revenue (line 1 plus line 2) ........................................................................................................................

3

4.

Expenses:

a

Expenses Allocated to Program Services .................................................

4a

b.

Expenses Allocated to Management and General .....................................

4b

c.

Expenses Allocated to Fund-raising .........................................................

4c

d.

Expenses Allocated to Payments to Affiliates ..........................................

4d

e.

Total Expenses .............................................................................................................................................

4e

5.

Excess or Deficit (line 3 minus line 4e) ................................................................................................................

5

6.

Net Assets at Beginning of Year ..........................................................................................................................

6

7.

Other Changes in Net Assets or Fund Balances (See 990, part XI) .......................................................................

7

8.

Net Assets at End of Year ....................................................................................................................................

8

ATTACHMENTS

Check the box next to the items that are attached to your annual report. Items A., B., and C. are required. Item D. or E. is required if

the contributions received by your organization fall into the described ranges.

(Note: If you are submitting this form with your

initial application, DO NOT submit the following attachments. Submit the attachments cited in the application form instead).

A. List of all officers, directors, trustees, and principal salaried employees – The list must include each

individual’s name, address, and title.

Please note that “principal salaried employees” refers to the chief

administrative officers of your organization, but does not include the heads of separate departments or smaller units

within the organization. (You can disregard this item if you are attaching an IRS 990 that already includes the

requested information.)

B. A list of states that have issued a license, registration, permit, or other formal authorization to the

organization to solicit contributions. (You can disregard this item if you are attaching an IRS 990 that already

includes the requested information.)

CO WI SUPPLEMENT TO FINANCIAL REPORT

Page 4 of 5

DFI/LFS/1952 (R 3/2014)

1

1 2

2 3

3 4

4 5

5