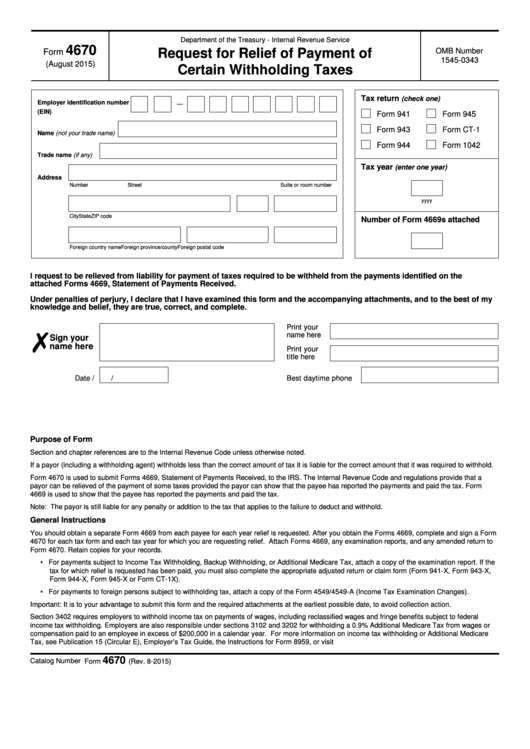

Department of the Treasury - Internal Revenue Service

4670

Request for Relief of Payment of

OMB Number

Form

1545-0343

(August 2015)

Certain Withholding Taxes

Tax return

(check one)

Employer identification number

—

(EIN)

Form 941

Form 945

Form 943

Form CT-1

Name (not your trade name)

Form 944

Form 1042

Trade name (if any)

Tax year

(enter one year)

Address

Number

Street

Suite or room number

yyyy

City

State

ZIP code

Number of Form 4669s attached

Foreign country name

Foreign province/county

Foreign postal code

I request to be relieved from liability for payment of taxes required to be withheld from the payments identified on the

attached Forms 4669, Statement of Payments Received.

Under penalties of perjury, I declare that I have examined this form and the accompanying attachments, and to the best of my

knowledge and belief, they are true, correct, and complete.

Print your

✗

name here

Sign your

name here

Print your

title here

Date

/

/

Best daytime phone

Purpose of Form

Section and chapter references are to the Internal Revenue Code unless otherwise noted.

If a payor (including a withholding agent) withholds less than the correct amount of tax it is liable for the correct amount that it was required to withhold.

Form 4670 is used to submit Forms 4669, Statement of Payments Received, to the IRS. The Internal Revenue Code and regulations provide that a

payor can be relieved of the payment of some taxes provided the payor can show that the payee has reported the payments and paid the tax. Form

4669 is used to show that the payee has reported the payments and paid the tax.

Note: The payor is still liable for any penalty or addition to the tax that applies to the failure to deduct and withhold.

General Instructions

You should obtain a separate Form 4669 from each payee for each year relief is requested. After you obtain the Forms 4669, complete and sign a Form

4670 for each tax form and each tax year for which you are requesting relief. Attach Forms 4669, any examination reports, and any amended return to

Form 4670. Retain copies for your records.

• For payments subject to Income Tax Withholding, Backup Withholding, or Additional Medicare Tax, attach a copy of the examination report. If the

tax for which relief is requested has been paid, you must also complete the appropriate adjusted return or claim form (Form 941-X, Form 943-X,

Form 944-X, Form 945-X or Form CT-1X).

• For payments to foreign persons subject to withholding tax, attach a copy of the Form 4549/4549-A (Income Tax Examination Changes).

Important: It is to your advantage to submit this form and the required attachments at the earliest possible date, to avoid collection action.

Section 3402 requires employers to withhold income tax on payments of wages, including reclassified wages and fringe benefits subject to federal

income tax withholding. Employers are also responsible under sections 3102 and 3202 for withholding a 0.9% Additional Medicare Tax from wages or

compensation paid to an employee in excess of $200,000 in a calendar year. For more information on income tax withholding or Additional Medicare

Tax, see Publication 15 (Circular E), Employer’s Tax Guide, the Instructions for Form 8959, or visit

4670

Catalog Number 23290O

Form

(Rev. 8-2015)

1

1 2

2