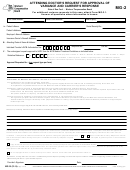

Form Rp-305-R-Ws-Assessor'S Worksheet For Rp-305-R Page 4

ADVERTISEMENT

RP-305-r (1/00)

New York State Board of Real Property Services

AGRICULTURAL ASSESSMENT PROGRAM

UPDATE

Notice To: Landowners applying for an Agricultural Assessment

CONSEQUENCE OF CONVERTING LAND TO A NONAGRICULTURAL USE:

The consequence of a conversion is a payment based on five times the taxes saved in the most recent

year of benefit. The payment also includes a six percent interest charge compounded annually for each year

during the last five, in which the land received an agricultural assessment. An encumbrance runs with the land

from the last time the parcel benefited for five years in an Agricultural District and for eight years outside a

district.

For land located outside an agricultural district the obligation to make a payment for conversion creates

a lien against the entire parcel, even if only a portion of the parcel benefited from the agricultural assessment.

Recent Program Changes

Three recent changes to Agriculture Districts Law are explained below.

(1)

Revised valuation method for organic soils(“muck, black dirt”) - Effective in 1999,organic

soils are valued by indexing the Organic soil group A at 2 times the agricultural assessment value of Mineral

Soil Group 1a. This results in a lower agricultural assessment value for organic soils.

(Organic Soil Groups B,C & D are 65, 55 & 35 percent of Organic Soil Group A respectively.)

(2) Land set aside through participation in a federal conservation program pursuant to Title One

of the Federal Food Security Act of 1985 or any subsequent federal programs established for the purposes of

replenishing highly erodible land which has been depleted by continuous tilling or reducing national surpluses

of agricultural commodities shall qualify for agricultural assessment except that no minimum gross sales

value shall be required. Now all lands set aside in federal programs cited above will qualify as land used in

agricultural production regardless of income. Additionally, the income derived from federal program payments

may be included in the gross sales calculation for determining eligibility for other lands that are part of the

same single operation. Annual application is still required.

(Note: Opinions of Counsel of the Office of Real Property Services 8-71 and 10-57 have been superseded by

this legislative change.)

(3)

Newly planted or replanted orchards and vineyards - This provision waives the 20%

maximum newly planted acreage allowed for this exemption when the orchard or vineyard is within an area

declared by the Governor to be a State Disaster Emergency. The orchard/vineyard area may not exceed the

area damaged or destroyed by the disaster.

This brief explanation of major provisions of the amended agricultural districts law should be

fully understood by you prior to application. If you do not understand, contact your attorney.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4