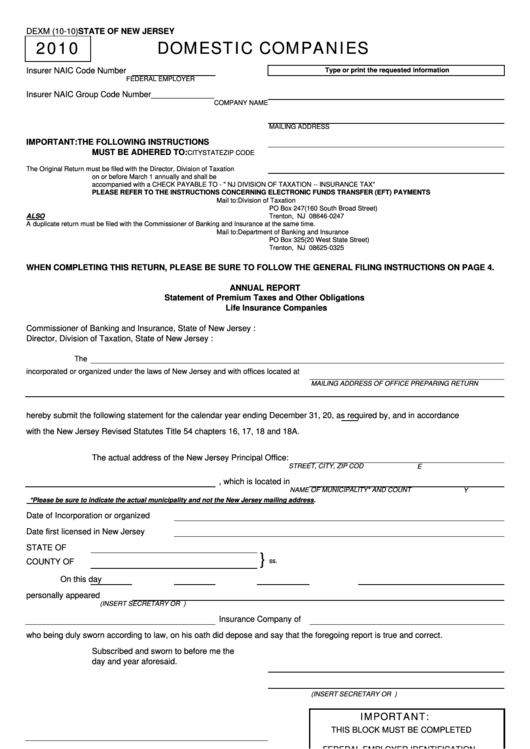

DEXM (10-10)

STATE OF NEW JERSEY

2010

DOMESTIC COMPANIES

Insurer NAIC Code Number

Type or print the requested information

FEDERAL EMPLOYER I.D. NUMBER

Insurer NAIC Group Code Number______________

COMPANY NAME

MAILING ADDRESS

IMPORTANT:

THE FOLLOWING INSTRUCTIONS

MUST BE ADHERED TO:

CITY

STATE

ZIP CODE

The Original Return must be filed with the Director, Division of Taxation

on or before March 1 annually and shall be

accompanied with a CHECK PAYABLE TO - " NJ DIVISION OF TAXATION -- INSURANCE TAX"

PLEASE REFER TO THE INSTRUCTIONS CONCERNING ELECTRONIC FUNDS TRANSFER (EFT) PAYMENTS

Mail to:

Division of Taxation

PO Box 247

(160 South Broad Street)

ALSO

Trenton, NJ 08646-0247

A duplicate return must be filed with the Commissioner of Banking and Insurance at the same time.

Mail to:

Department of Banking and Insurance

PO Box 325

(20 West State Street)

Trenton, NJ 08625-0325

WHEN COMPLETING THIS RETURN, PLEASE BE SURE TO FOLLOW THE GENERAL FILING INSTRUCTIONS ON PAGE 4.

ANNUAL REPORT

Statement of Premium Taxes and Other Obligations

Life Insurance Companies

Commissioner of Banking and Insurance, State of New Jersey :

Director, Division of Taxation, State of New Jersey :

The

incorporated or organized under the laws of New Jersey and with offices located at

MAILING ADDRESS OF OFFICE PREPARING RETURN

hereby submit the following statement for the calendar year ending December 31, 20

, as required by, and in accordance

with the New Jersey Revised Statutes Title 54 chapters 16, 17, 18 and 18A.

The actual address of the New Jersey Principal Office:

STREET, CITY, ZIP CODE

, which is located in

NAME OF MUNICIPALITY* AND COUNTY

*Please be sure to indicate the actual municipality and not the New Jersey mailing address.

Date of Incorporation or organized

Date first licensed in New Jersey

STATE OF

}

ss.

COUNTY OF

On this

day of

A.D. 20

before me

personally appeared

(INSERT SECRETARY OR U.S. MANAGER)

Insurance Company of

who being duly sworn according to law, on his oath did depose and say that the foregoing report is true and correct.

Subscribed and sworn to before me the

day and year aforesaid.

(INSERT SECRETARY OR U.S. MANAGER)

IMPORTANT:

THIS BLOCK MUST BE COMPLETED

FEDERAL EMPLOYER IDENTIFICATION

NUMBER

(OFFICIAL TITLE)

(NAME OF PARTY TO CONTACT REGARDING THIS RETURN)

(TITLE)

(PHONE NUMBER)

(FAX NUMBER)

(SIGNATURE OF INDIVIDUAL PREPARING THIS RETURN)

(PREPARER'S IDENTIFICATION NUMBER)

(NAME OF TAX PREPARER'S EMPLOYER)

(EMPLOYER'S IDENTIFICATION NUMBER)

1

1 2

2 3

3 4

4 5

5