Form Ptr-2a - Homeowners Verification Of 2002 Property Taxes

ADVERTISEMENT

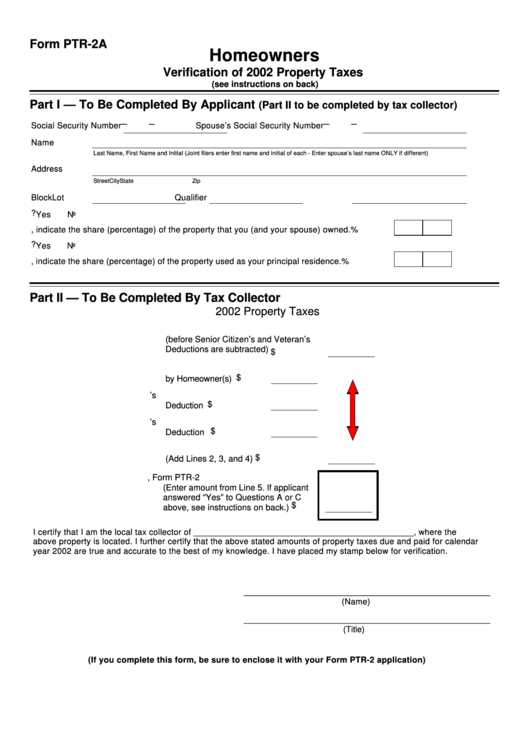

Form PTR-2A

Homeowners

Verification of 2002 Property Taxes

(see instructions on back)

Part I — To Be Completed By Applicant

(Part II to be completed by tax collector)

–

–

–

–

Social Security Number

Spouse’s Social Security Number

Name

Last Name, First Name and Initial (Joint filers enter first name and initial of each - Enter spouse’s last name ONLY if different)

Address

Street

City

State

Zip

Block

Lot

Qualifier

A. Did you own your principal residence with someone who was not your spouse?

Yes

No

B. If yes, indicate the share (percentage) of the property that you (and your spouse) owned.

%

C. Does your principal residence have more than one dwelling unit?

Yes

No

D. If yes, indicate the share (percentage) of the property used as your principal residence.

%

Part II — To Be Completed By Tax Collector

2002 Property Taxes

1. Total Amount Levied by Municipality

(before Senior Citizen’s and Veteran’s

Deductions are subtracted) .................... $

2. Total Amount Paid

by Homeowner(s) .......... $

3. Senior Citizen’s

Deduction ........................ $

4. Veteran’s

Deduction ...................... $

5. Total Credits

(Add Lines 2, 3, and 4) ........................... $

6. Amount for Line 10, Form PTR-2

(Enter amount from Line 5. If applicant

answered “Yes” to Questions A or C

above, see instructions on back.)........... $

I certify that I am the local tax collector of ______________________________________________, where the

above property is located. I further certify that the above stated amounts of property taxes due and paid for calendar

year 2002 are true and accurate to the best of my knowledge. I have placed my stamp below for verification.

__________________________________________

(Name)

__________________________________________

(Title)

(If you complete this form, be sure to enclose it with your Form PTR-2 application)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2