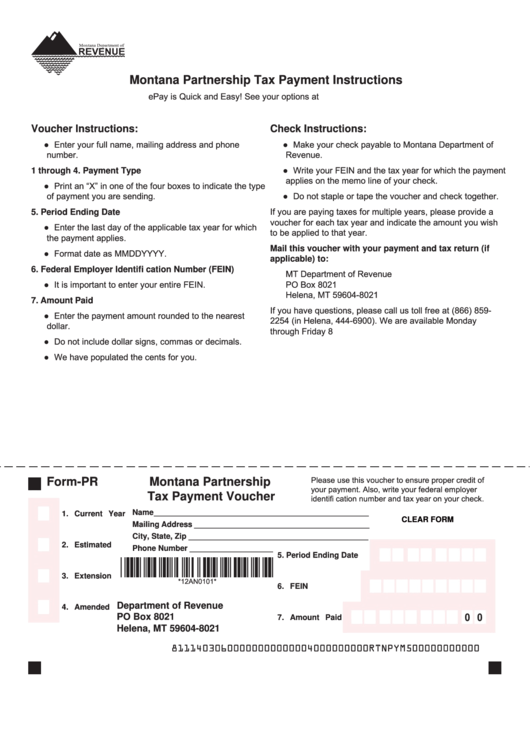

Montana Partnership Tax Payment Instructions

ePay is Quick and Easy! See your options at revenue.mt.gov

Voucher Instructions:

Check Instructions:

● Enter your full name, mailing address and phone

● Make your check payable to Montana Department of

number.

Revenue.

● Write your FEIN and the tax year for which the payment

1 through 4. Payment Type

applies on the memo line of your check.

● Print an “X” in one of the four boxes to indicate the type

of payment you are sending.

● Do not staple or tape the voucher and check together.

If you are paying taxes for multiple years, please provide a

5. Period Ending Date

voucher for each tax year and indicate the amount you wish

● Enter the last day of the applicable tax year for which

to be applied to that year.

the payment applies.

Mail this voucher with your payment and tax return (if

● Format date as MMDDYYYY.

applicable) to:

6. Federal Employer Identifi cation Number (FEIN)

MT Department of Revenue

● It is important to enter your entire FEIN.

PO Box 8021

Helena, MT 59604-8021

7. Amount Paid

If you have questions, please call us toll free at (866) 859-

● Enter the payment amount rounded to the nearest

2254 (in Helena, 444-6900). We are available Monday

dollar.

through Friday 8 a.m. to 5 p.m.

● Do not include dollar signs, commas or decimals.

● We have populated the cents for you.

Please use this voucher to ensure proper credit of

Form-PR

Montana Partnership

your payment. Also, write your federal employer

Tax Payment Voucher

identifi cation number and tax year on your check.

Name _________________________________________________

1. Current Year

CLEAR FORM

Mailing Address ________________________________________

City, State, Zip _________________________________________

2. Estimated

Phone Number ___________________

5. Period Ending Date

*12AN0101*

3. Extension

*12AN0101*

6. FEIN

Department of Revenue

4. Amended

PO Box 8021

0 0

7. Amount Paid

Helena, MT 59604-8021

81114030600000000000004000000000RTNPYM500000000000

1

1