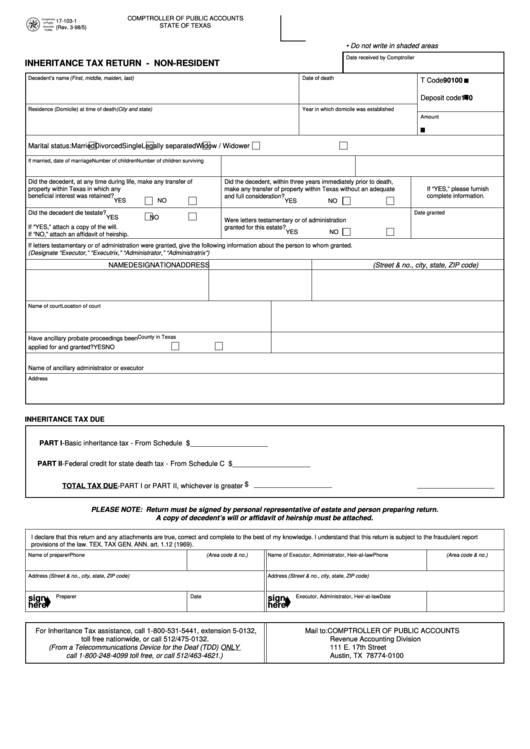

Form 17-103-1 - Inheritance Tax Return - Non-Resident

ADVERTISEMENT

COMPTROLLER OF PUBLIC ACCOUNTS

17-103-1

STATE OF TEXAS

(Rev. 3-98/5)

• Do not write in shaded areas

Date received by Comptroller

INHERITANCE TAX RETURN - NON-RESIDENT

Decedent’s name (First, middle, maiden, last)

Date of death

T Code

90100

Deposit code

110

Residence (Domicile) at time of death (City and state)

Year in which domicile was established

Amount

Marital status:

Married

Divorced

Single

Legally separated

Widow / Widower

If married, date of marriage

Number of children

Number of children surviving

Did the decedent, at any time during life, make any transfer of

Did the decedent, within three years immediately prior to death,

property within Texas in which any

If “YES,” please furnish

make any transfer of property within Texas without an adequate

beneficial interest was retained?

and full consideration?

complete information.

YES

NO

YES

NO

Did the decedent die testate?

Date granted

YES

NO

Were letters testamentary or of administration

If “YES,” attach a copy of the will.

granted for this estate?

YES

NO

If “NO,” attach an affidavit of heirship.

If letters testamentary or of administration were granted, give the following information about the person to whom granted.

(Designate “Executor,” “Executrix,” “Administrator,” “Administratrix”)

NAME

DESIGNATION

ADDRESS (Street & no., city, state, ZIP code)

Name of court

Location of court

County in Texas

Have ancillary probate proceedings been

applied for and granted?

YES

NO

Name of ancillary administrator or executor

Address

INHERITANCE TAX DUE

PART I - Basic inheritance tax - From Schedule B ....................................................

$ ____________________

PART II - Federal credit for state death tax - From Schedule C .................................

$ ____________________

TOTAL TAX DUE - PART I or PART II, whichever is greater .............................................................................

$ ____________________

PLEASE NOTE: Return must be signed by personal representative of estate and person preparing return.

A copy of decedent’s will or affidavit of heirship must be attached.

I declare that this return and any attachments are true, correct and complete to the best of my knowledge. I understand that this return is subject to the fraudulent report

provisions of the law. TEX. TAX GEN. ANN. art. 1.12 (1969).

Name of preparer

Phone (Area code & no.)

Name of Executor, Administrator, Heir-at-law

Phone (Area code & no.)

Address (Street & no., city, state, ZIP code)

Address (Street & no., city, state, ZIP code)

sign

Preparer

Date

sign

Executor, Administrator, Heir-at-law

Date

here

here

For Inheritance Tax assistance, call 1-800-531-5441, extension 5-0132,

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

toll free nationwide, or call 512/475-0132.

Revenue Accounting Division

(From a Telecommunications Device for the Deaf (TDD) ONLY

111 E. 17th Street

call 1-800-248-4099 toll free, or call 512/463-4621.)

Austin, TX 78774-0100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4