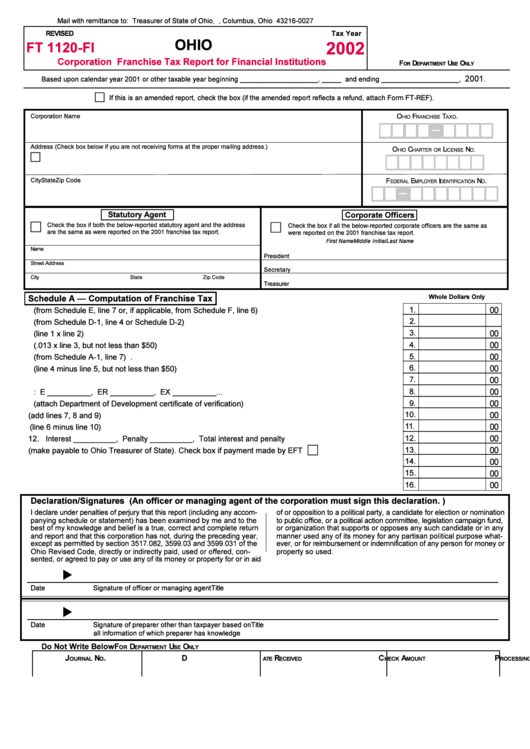

Form Ft 1120-Fi - 2002 Corporation Franchise Tax Report For Financial Institutions

ADVERTISEMENT

Mail with remittance to: Treasurer of State of Ohio, P.O. Box 27, Columbus, Ohio 43216-0027

REVISED

Tax Year

OHIO

2002

FT 1120-FI

Corporation Franchise Tax Report for Financial Institutions

F

D

U

O

OR

EPARTMENT

SE

NLY

2001

Based upon calendar year 2001 or other taxable year beginning ____________________, _____ and ending ____________________,

.

c

—

If this is an amended report, check the box (if the amended report reflects a refund, attach Form FT-REF).

O

F

T

I.D. N

.

Corporation Name

HIO

RANCHISE

AX

O

—

Address (Check box below if you are not receiving forms at the proper mailing address.)

O

C

L

N

.

HIO

HARTER OR

ICENSE

O

c

City

State

Zip Code

F

E

I

N

.

EDERAL

MPLOYER

DENTIFICATION

O

—

Statutory Agent

Corporate Officers

c

c

Check the box if both the below-reported statutory agent and the address

Check the box if all the below-reported corporate officers are the same as

are the same as were reported on the 2001 franchise tax report.

were reported on the 2001 franchise tax report.

First Name

Middle Initial

Last Name

Name

President

Street Address

Secretary

City

State

Zip Code

Treasurer

Schedule A — Computation of Franchise Tax

Whole Dollars Only

_________________

1.

00

1. Net value of stock (from Schedule E, line 7 or, if applicable, from Schedule F, line 6) .........................

_________________

2.

2. Apportionment ratio (from Schedule D-1, line 4 or Schedule D-2) .......................................................

_________________

3.

00

3. Taxable value (line 1 x line 2) .................................................................................................................

_________________

00

4.

4. Tax on net worth basis (.013 x line 3, but not less than $50) ................................................................

_________________

5.

00

5. Total nonrefundable credits (from Schedule A-1, line 7) .......................................................................

_________________

6.

00

6. Amount due after nonrefundable credits (line 4 minus line 5, but not less than $50) .........................

_________________

7.

00

7. Overpayment carryforward from 2001 ....................................................................................................

_________________

8.

00

8. Estimated payments made in tax year 2002: E __________, ER __________, EX __________ ...

_________________

00

9.

9. New jobs refundable credit (attach Department of Development certificate of verification) .................

_________________

10.

00

10. Total payments and refundable credits (add lines 7, 8 and 9) ..............................................................

_________________

11.

00

11. Tax due (line 6 minus line 10) ................................................................................................................

_________________

00

12.

12. Interest __________, Penalty __________, Total interest and penalty .................................................

_________________

c

13.

00

13. Balance due (make payable to Ohio Treasurer of State). Check box if payment made by EFT

....

_________________

14.

00

14. Overpayment ..........................................................................................................................................

_________________

15.

00

15. Amount of line 14 to be credited to tax year 2003 estimated tax ...........................................................

16.

00

16. Amount of line 14 to be refunded ...........................................................................................................

Declaration/Signatures (An officer or managing agent of the corporation must sign this declaration. )

I declare under penalties of perjury that this report (including any accom-

of or opposition to a political party, a candidate for election or nomination

panying schedule or statement) has been examined by me and to the

to public office, or a political action committee, legislation campaign fund,

best of my knowledge and belief is a true, correct and complete return

or organization that supports or opposes any such candidate or in any

and report and that this corporation has not, during the preceding year,

manner used any of its money for any partisan political purpose what-

except as permitted by section 3517.082, 3599.03 and 3599.031 of the

ever, or for reimbursement or indemnification of any person for money or

Ohio Revised Code, directly or indirectly paid, used or offered, con-

property so used.

sented, or agreed to pay or use any of its money or property for or in aid

Date

Signature of officer or managing agent

Title

Date

Signature of preparer other than taxpayer based on

Title

all information of which preparer has knowledge

Do Not Write Below

F

D

U

O

OR

EPARTMENT

SE

NLY

J

N

.

D

R

C

A

P

C

OURNAL

O

ATE

ECEIVED

HECK

MOUNT

ROCESSING

ODE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4