Form Rp-466-E - Application For Volunteer Firefighters/volunteer Ambulance Workers Exemption, Lewis - 2007

ADVERTISEMENT

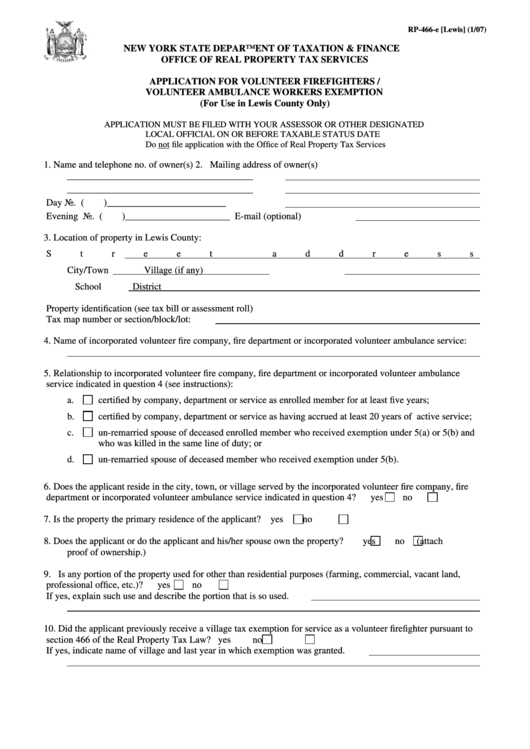

RP-466-e [Lewis] (1/07)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR VOLUNTEER FIREFIGHTERS /

VOLUNTEER AMBULANCE WORKERS EXEMPTION

(For Use in Lewis County Only)

APPLICATION MUST BE FILED WITH YOUR ASSESSOR OR OTHER DESIGNATED

LOCAL OFFICIAL ON OR BEFORE TAXABLE STATUS DATE

Do not file application with the Office of Real Property Tax Services

1.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

_______________________________________

_______________________________________

Day No. (

) _________________________

Evening No. (

)______________________

E-mail (optional)

3.

Location of property in Lewis County:

Street address

City/Town

Village (if any)

School District

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot:

4.

Name of incorporated volunteer fire company, fire department or incorporated volunteer ambulance service:

5.

Relationship to incorporated volunteer fire company, fire department or incorporated volunteer ambulance

service indicated in question 4 (see instructions):

a.

certified by company, department or service as enrolled member for at least five years;

b.

certified by company, department or service as having accrued at least 20 years of active service;

c.

un-remarried spouse of deceased enrolled member who received exemption under 5(a) or 5(b) and

who was killed in the same line of duty; or

d.

un-remarried spouse of deceased member who received exemption under 5(b).

6.

Does the applicant reside in the city, town, or village served by the incorporated volunteer fire company, fire

department or incorporated volunteer ambulance service indicated in question 4?

yes

no

7.

Is the property the primary residence of the applicant?

yes

no

8.

Does the applicant or do the applicant and his/her spouse own the property?

yes

no

(attach

proof of ownership.)

9.

Is any portion of the property used for other than residential purposes (farming, commercial, vacant land,

professional office, etc.)?

yes

no

If yes, explain such use and describe the portion that is so used.

10.

Did the applicant previously receive a village tax exemption for service as a volunteer firefighter pursuant to

section 466 of the Real Property Tax Law?

yes

no

If yes, indicate name of village and last year in which exemption was granted.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2