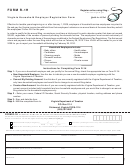

2015-2016 Household Resources Verification Form

SECTION 3 - Untaxed Income

Student ID: ____________________

Please list calendar year 2014 annual income. Enter “0” if you or your parent(s) did not receive any of that income.

Enter amounts received for the full calendar year. Do NOT enter monthly amounts.

Student/

Spouse

Parent

Source of income

2014

2014 income

income

Payments to tax-deferred pension and retirement savings plans (paid

directly or withheld from earnings), including, but not limited to, amounts

$

$

reported on the W-2 Form in Boxes 12a through 12d, codes D, E, F, G, H, and

S.

Child support you received for all children. Do not include foster care or

adoption payments. (Please list each child and amount individually below and

report the total amount received in 2014 in the appropriate box to the left or

right)

$

$

Name(s) of Child(ren) for whom support is received:

_______________________________________________________________

_______________________________________________________________

Housing, food, and other living allowances paid to members of the

military, clergy, and others (including cash payments and cash value of

$

benefits).

$

Do not include Food Stamps (SNAP), government sponsored housing subsidies

or the value of on-base military housing, or welfare benefits.

Veterans’ non-education benefits such as Disability, Death Pension, or

$

Dependency & Indemnity Compensation (DIC), and/or VA Educational Work-

$

Study allowances

Any other untaxed income or benefits not reported, such as workers’

compensation, disability, etc.

Do not include untaxed Social Security benefits (retirement or SSDI),

$

Supplemental Security Income, welfare benefits, Workforce Investment Act

$

educational benefits, combat pay, student aid, additional child tax credit, earned

income credit, benefits from flexible spending arrangements, (e.g. cafeteria

plans), foreign income exclusion or credit for federal tax on special fuels.

Money received, or paid on student’s behalf (e.g., payment of bills), not

$

XXXXXXX

reported elsewhere on this form

SECTION 4 - Signatures

I/we certify that all of the information on this form is complete and correct.

Student’s Signature: ____________________________________________

Date: ____________________

Parent’s Signature: _____________________________________________

Date: ____________________

Financial Aid Office Quinsigamond Community College

670 West Boylston St. Worcester, MA 01606

Office hours: Monday-Thursday 8-7, Fridays 8-5

Phone: (508) 854-4261 Fax: (508) 854-7432

financialaid@qcc.mass.edu

1

1 2

2