Print Form

Reset Form

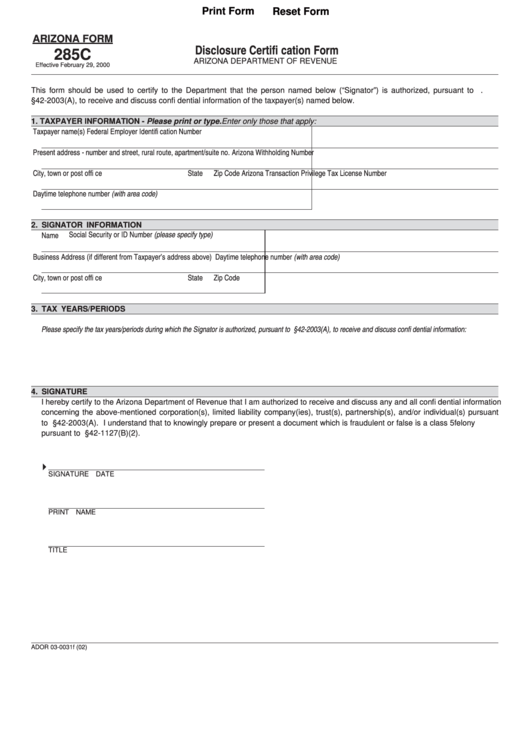

ARIZONA FORM

Disclosure Certifi cation Form

285C

ARIZONA DEPARTMENT OF REVENUE

Effective February 29, 2000

This form should be used to certify to the Department that the person named below (“Signator”) is authorized, pursuant to A.R.S.

§42-2003(A), to receive and discuss confi dential information of the taxpayer(s) named below.

1. TAXPAYER INFORMATION - Please print or type.

Enter only those that apply:

Taxpayer name(s)

Federal Employer Identifi cation Number

Present address - number and street, rural route, apartment/suite no.

Arizona Withholding Number

City, town or post offi ce

State

Zip Code

Arizona Transaction Privilege Tax License Number

Daytime telephone number (with area code)

2. SIGNATOR INFORMATION

Social Security or ID Number (please specify type)

Name

Business Address (if different from Taxpayer’s address above)

Daytime telephone number (with area code)

City, town or post offi ce

State

Zip Code

3. TAX YEARS/PERIODS

Please specify the tax years/periods during which the Signator is authorized, pursuant to A.R.S. §42-2003(A), to receive and discuss confi dential information:

4. SIGNATURE

I hereby certify to the Arizona Department of Revenue that I am authorized to receive and discuss any and all confi dential information

concerning the above-mentioned corporation(s), limited liability company(ies), trust(s), partnership(s), and/or individual(s) pursuant

to A.R.S. §42-2003(A). I understand that to knowingly prepare or present a document which is fraudulent or false is a class 5 felony

pursuant to A.R.S. §42-1127(B)(2).

SIGNATURE

DATE

PRINT NAME

TITLE

ADOR 03-0031f (02)

1

1