Form Mw-1 - Montana Withholding Tax (75) Payment Instructions

ADVERTISEMENT

Clear Form

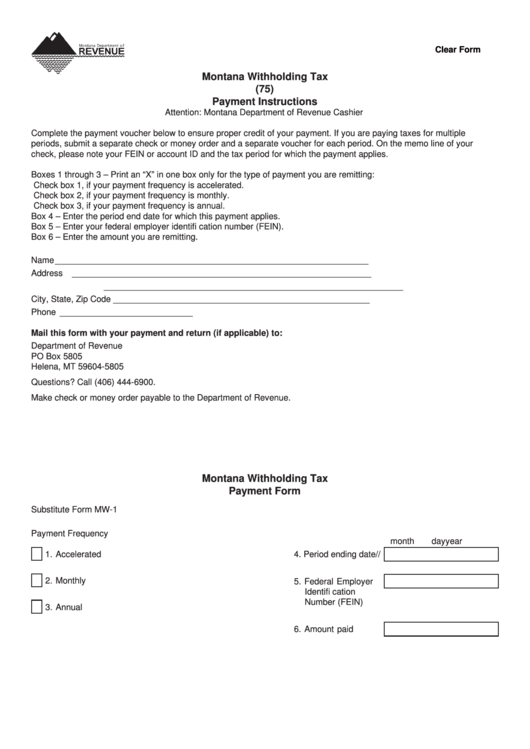

Montana Withholding Tax

(75)

Payment Instructions

Attention: Montana Department of Revenue Cashier

Complete the payment voucher below to ensure proper credit of your payment. If you are paying taxes for multiple

periods, submit a separate check or money order and a separate voucher for each period. On the memo line of your

check, please note your FEIN or account ID and the tax period for which the payment applies.

Boxes 1 through 3 – Print an “X” in one box only for the type of payment you are remitting:

Check box 1, if your payment frequency is accelerated.

Check box 2, if your payment frequency is monthly.

Check box 3, if your payment frequency is annual.

Box 4 –

Enter the period end date for which this payment applies.

Box 5 –

Enter your federal employer identifi cation number (FEIN).

Box 6 –

Enter the amount you are remitting.

Name __________________________________________________________________

Address _______________________________________________________________

_______________________________________________________________

City, State, Zip Code ______________________________________________________

Phone ____________________________

Mail this form with your payment and return (if applicable) to:

Department of Revenue

PO Box 5805

Helena, MT 59604-5805

Questions? Call (406) 444-6900.

Make check or money order payable to the Department of Revenue.

Montana Withholding Tax

Payment Form

Substitute Form MW-1

Payment Frequency

month

day

year

1. Accelerated

4. Period ending date

/

/

2. Monthly

5. Federal Employer

Identifi cation

Number (FEIN)

3. Annual

6. Amount paid

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1