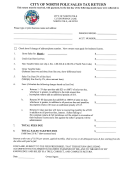

Combined Sales Tax And Business License Applicationand Business Occupation Tax Return - City Of Aspen Page 2

ADVERTISEMENT

Liquor License Holders............................................................................................$ -0-

Not For Profit Groups....(IRS Section 501(C).(3) Certificate Required)....................$ -0-

ß

à

CONTINUED ON REVERSE SIDE

code 111087

I declare under penalty of perjury that this application has been examined by me, and that the statements made herein are made in good

faith pursuant to the City of Aspen tax regulations and, to the best of my knowledge and belief, are true, correct and complete.

SIGNATURE OF APPLICANT:_________________________________________________

DATE:________________________

PLEASE RETURN THIS APPLICATION ALONG WITH YOUR REMITTANCE OF THE

APPROPRIATE BUSINESS OCCUPATION TAXES, (

AS CALUCULATED ON THE FRONT OF THIS

), PAYABLE TO THE CITY OF ASPEN

APPLICATION

__________________________________________________________________________________________

FOR CITY STAFF ONLY

APPROVAL

DATE

ZONING –

Community Development

rd

3

Floor of City Hall

Sarah Oates 970- 920-5441

.

.

ENVIRONMENTAL HEALTH –

Primarily for Food Handling and

Hazardous Chemicals

nd

2

Floor of City Hall

970- 920-5070

.

.

FIRE MARSHALL –

Located in the Fire Dept. 970- 925-2690

.

.

FINANCE DEPT –

st

1

Floor of City Hall

Pay Cashier the Appropriate Business Occupation Tax

See Larry Thoreson for Issuance of License

970-920-5029

.

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2