Application For Tuition Grant Academic Year 2015-16

ADVERTISEMENT

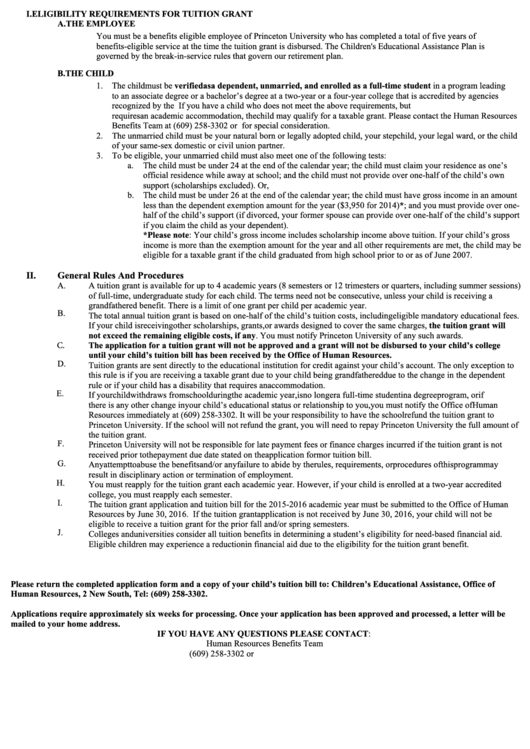

I.

ELIGIBILITY REQUIREMENTS FOR TUITION GRANT

A.

THE EMPLOYEE

You must be a benefits eligible employee of Princeton University who has completed a total of five years of

benefits-eligible service at the time the tuition grant is disbursed. The Children's Educational Assistance Plan is

governed by the break-in-service rules that govern our retirement plan.

B.

THE CHILD

1. The child must be verified as a dependent, unmarried, and enrolled as a full-time student in a program leading

to an associate degree or a bachelor’s degree at a two-year or a four-year college that is accredited by agencies

recognized by the U.S. Department of Education. If you have a child who does not meet the above requirements, but

requires an academic accommodation, the child may qualify for a taxable grant. Please contact the Human Resources

Benefits Team at (609) 258-3302 or benefits@princeton.edu for special consideration.

2. The unmarried child must be your natural born or legally adopted child, your stepchild, your legal ward, or the child

of your same-sex domestic or civil union partner.

3. To be eligible, your unmarried child must also meet one of the following tests:

a.

The child must be under 24 at the end of the calendar year; the child must claim your residence as one’s

official residence while away at school; and the child must not provide over one-half of the child’s own

support (scholarships excluded). Or,

b. The child must be under 26 at the end of the calendar year; the child must have gross income in an amount

less than the dependent exemption amount for the year ($3,950 for 2014)*; and you must provide over one-

half of the child’s support (if divorced, your former spouse can provide over one-half of the child’s support

if you claim the child as your dependent).

*Please note: Your child’s gross income includes scholarship income above tuition. If your child’s gross

income is more than the exemption amount for the year and all other requirements are met, the child may be

eligible for a taxable grant if the child graduated from high school prior to or as of June 2007.

II.

General Rules And Procedures

A.

A tuition grant is available for up to 4 academic years (8 semesters or 12 trimesters or quarters, including summer sessions)

of full-time, undergraduate study for each child. The terms need not be consecutive, unless your child is receiving a

grandfathered benefit. There is a limit of one grant per child per academic year.

B.

The total annual tuition grant is based on one-half of the child’s tuition costs, including eligible mandatory educational fees.

If your child is receiving other scholarships, grants, or awards designed to cover the same charges, the tuition grant will

not exceed the remaining eligible costs, if any. You must notify Princeton University of any such awards.

The application for a tuition grant will not be approved and a grant will not be disbursed to your child’s college

C.

until your child’s tuition bill has been received by the Office of Human Resources.

D.

Tuition grants are sent directly to the educational institution for credit against your child’s account. The only exception to

this rule is if you are receiving a taxable grant due to your child being grandfathered due to the change in the dependent

rule or if your child has a disability that requires an accommodation.

If your child withdraws from school during the academic year, is no longer a full-time student in a degree program, or if

E.

there is any other change in your child’s educational status or relationship to you, you must notify the Office of Human

Resources immediately at (609) 258-3302. It will be your responsibility to have the school refund the tuition grant to

Princeton University. If the school will not refund the grant, you will need to repay Princeton University the full amount of

the tuition grant.

Princeton University will not be responsible for late payment fees or finance charges incurred if the tuition grant is not

F.

received prior to the payment due date stated on the application form or tuition bill.

Any attempt to abuse the benefits and/or any failure to abide by the rules, requirements, or procedures of this program may

G.

result in disciplinary action or termination of employment.

H.

You must reapply for the tuition grant each academic year. However, if your child is enrolled at a two-year accredited

college, you must reapply each semester.

I.

The tuition grant application and tuition bill for the 2015-2016 academic year must be submitted to the Office of Human

Resources by June 30, 2016. If the tuition grant application is not received by June 30, 2016, your child will not be

eligible to receive a tuition grant for the prior fall and/or spring semesters.

J.

Colleges and universities consider all tuition benefits in determining a student’s eligibility for need-based financial aid.

Eligible children may experience a reduction in financial aid due to the eligibility for the tuition grant benefit.

Please return the completed application form and a copy of your child’s tuition bill to: Children’s Educational Assistance, Office of

Human Resources, 2 New South, Tel: (609) 258-3302.

Applications require approximately six weeks for processing. Once your application has been approved and processed, a letter will be

mailed to your home address.

IF YOU HAVE ANY QUESTIONS PLEASE CONTACT:

Human Resources Benefits Team

(609) 258-3302 or benefits@princeton.edu

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2