Form Exc-Gas-Bnd-01.01 - Surety Bond Posted To Secure Performance Under Nevada Revised Statutes

ADVERTISEMENT

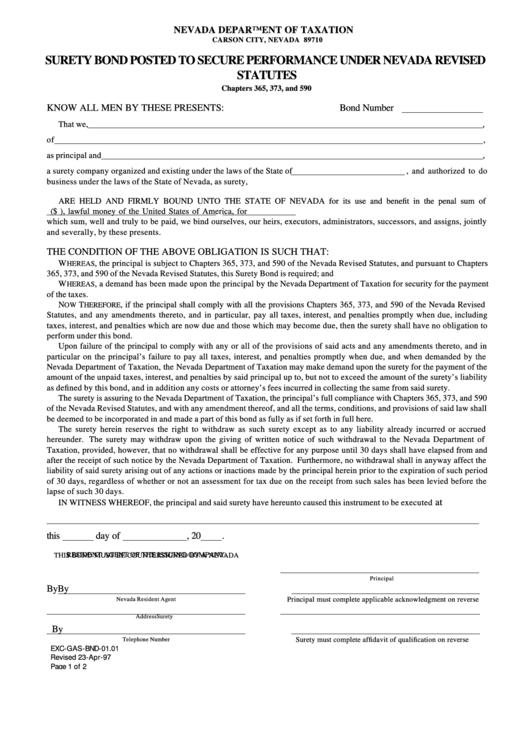

NEVADA DEPARTMENT OF TAXATION

CARSON CITY, NEVADA 89710

SURETY BOND POSTED TO SECURE PERFORMANCE UNDER NEVADA REVISED

STATUTES

Chapters 365, 373, and 590

KNOW ALL MEN BY THESE PRESENTS:

Bond Number

That we,

,

of

,

as principal and

,

a surety company organized and existing under the laws of the State of

, and authorized to do

business under the laws of the State of Nevada, as surety,

ARE HELD AND FIRMLY BOUND UNTO THE STATE OF NEVADA for its use and benefit in the penal sum of

($

), lawful money of the United States of America, for

which sum, well and truly to be paid, we bind ourselves, our heirs, executors, administrators, successors, and assigns, jointly

and severally, by these presents.

THE CONDITION OF THE ABOVE OBLIGATION IS SUCH THAT:

W

, the principal is subject to Chapters 365, 373, and 590 of the Nevada Revised Statutes, and pursuant to Chapters

HEREAS

365, 373, and 590 of the Nevada Revised Statutes, this Surety Bond is required; and

W

, a demand has been made upon the principal by the Nevada Department of Taxation for security for the payment

HEREAS

of the taxes.

N

T

, if the principal shall comply with all the provisions Chapters 365, 373, and 590 of the Nevada Revised

OW

HEREFORE

Statutes, and any amendments thereto, and in particular, pay all taxes, interest, and penalties promptly when due, including

taxes, interest, and penalties which are now due and those which may become due, then the surety shall have no obligation to

perform under this bond.

Upon failure of the principal to comply with any or all of the provisions of said acts and any amendments thereto, and in

particular on the principal’s failure to pay all taxes, interest, and penalties promptly when due, and when demanded by the

Nevada Department of Taxation, the Nevada Department of Taxation may make demand upon the surety for the payment of the

amount of the unpaid taxes, interest, and penalties by said principal up to, but not to exceed the amount of the surety’s liability

as defined by this bond, and in addition any costs or attorney’s fees incurred in collecting the same from said surety.

The surety is assuring to the Nevada Department of Taxation, the principal’s full compliance with Chapters 365, 373, and 590

of the Nevada Revised Statutes, and with any amendment thereof, and all the terms, conditions, and provisions of said law shall

be deemed to be incorporated in and made a part of this bond as fully as if set forth in full here.

The surety herein reserves the right to withdraw as such surety except as to any liability already incurred or accrued

hereunder. The surety may withdraw upon the giving of written notice of such withdrawal to the Nevada Department of

Taxation, provided, however, that no withdrawal shall be effective for any purpose until 30 days shall have elapsed from and

after the receipt of such notice by the Nevada Department of Taxation. Furthermore, no withdrawal shall in anyway affect the

liability of said surety arising out of any actions or inactions made by the principal herein prior to the expiration of such period

of 30 days, regardless of whether or not an assessment for tax due on the receipt from such sales has been levied before the

lapse of such 30 days.

at

IN WITNESS WHEREOF, the principal and said surety have hereunto caused this instrument to be executed

this

day of

, 20

.

THIS BOND MUST BE COUNTERSIGNED BY A NEVADA

RESIDENT AGENT OF THE ISSUING COMPANY.

Principal

By

By

Nevada Resident Agent

Principal must complete applicable acknowledgment on reverse

Address

Surety

By

Telephone Number

Surety must complete affidavit of qualification on reverse

EXC-GAS-BND-01.01

Revised 23-Apr-97

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2