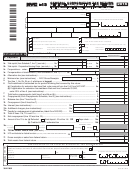

Form NYC-4S-EZ - 2007

Page 2

NAME _______________________________________________________________________

EIN _______________________________________

SCHEDULE B1

To be used by New York State C Corporations that elect to use NYS entire net income. See instructions.

1. New York State Entire Net Income............................................................................ 1.

2. General Corporation Tax deducted in computing amount on line 1 .......................... 2.

3. Total of lines 1 and 2 (Enter on page 1, Schedule A, Line 1) .................................... 3.

SCHEDULE B2

To be used by New York State S Corporations and C Corporations that do not elect to use Schedule B1. See instructions.

1. Federal Taxable Income before net operating loss deduction and special deductions.. 1.

2. State and local income taxes deducted on federal return (see instructions)............. 2.

3. Total of lines 1 and 2 ................................................................................................. 3.

4. New York City net operating loss deduction (see instructions) ................................. 4.

5. New York City and New York State income tax refunds included in Schedule B2, line1 ....5.

6. Taxable net income. Line 3 less the sum of lines 4 and 5.

(Enter on page 1, Schedule A, Line 1) ...................................................................... 6.

RETURNS WITH REMITTANCES

RETURNS CLAIMING REFUNDS

ALL OTHER RETURNS

MAILING

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

INSTRUCTIONS:

PO BOX 5040

PO BOX 5050

PO BOX 5060

KINGSTON, NY 12402-5040

KINGSTON, NY 12402-5050

KINGSTON, NY 12402-5060

The due date for the calendar year 2007 return is on or before March 17, 2008.

For fiscal years beginning in 2007, file on or before the 15th day of the third month after the close of the fiscal year.

31120793

1

1 2

2