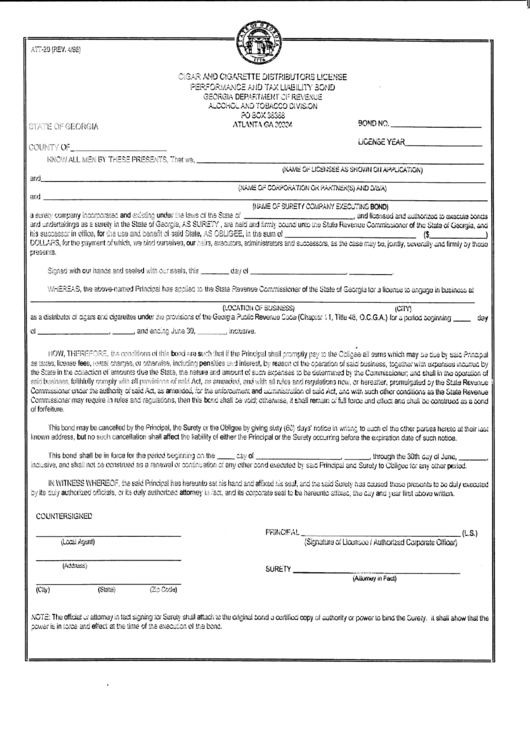

Form Att-20 - Cigar And Cigarette Distributors License Performance And Tax Liability Bond - 1998

ADVERTISEMENT

U

ATT-20 (REV. 4/98)

CIGAR AND CIGARETTE DISTRIBUTORS LICENSE

PERFORMANCE AND TAX LIABILITY BOND

GEORGIA DEPARTMENT OF REVENUE

ALCOHOL AND TOBACCO DIVISION

P0 BOX 38368

STATE OF GEORGIA

ATLANTA GA 30334

BOND NO.____________________

LICENSE YEAR__________________

COUNTY OF__________________

KNOW ALL MEN BY THESE PRESENTS, That we,

__________________________________________________________________

(NAME OF LICENSEE AS SHOWN ON APPLICATION)

and

(NAME OF CORPORATION OR PARTNER(S) AND DIBIA)

and

(NAME OF SURETY COMPANY EXECUTING BOND)

a surety company incorporated and existing under the laws ofthe State of

and licensed and authorized to execute bonds

_____________________________,

and undertakings as a surety in the State of Georgia, AS SURETY

are held and firmly bound untothe State Revenue Commissioner of the State of Georgia, and

,

his successor in office, for the use and benefit of said State, AS OBLIGEE, in the sum of

___________________________________

_______________

DOLLARS, for the payment ofwhich, we bind ourselves, our heirs, executors, administrators and successors, as the case may be, joinuy, severally and firmly by these

presents.

Signed with our hands and sealed with our seals, this

day of

________

____________________________I

____________

WHEREAS, the above-named Principal has applied to the State Revenue Commissioner of the State of Georgia for a license to engage in business at

(LOCATION OF BUSINESS)

(CIlY)

as a distributor of cigars and cigarettes under the provisions of the Georgia Public Revenue Code (Chapter ii, Title 48, O.C.G.A.) for a period beginning

day

of

and ending June 30, ________,inclusive.

___________________,

______,

NOW, THEREFORE, the conditions of this bond are such that if the Principal shall promptly pay to the Obligee all sums which may be due by said Principal

as taxes, licensefees, rental charges, orotherwise, induding penalties and interest, by reason of the operation of said business, together with expenses incurred by

the State in thecollection of amounts due the State, the nature and amount of such expenses to be determined by the Commissioner; and shall in the operation of

said business, faithfully comply with all provisions of said Act, as amended, and with all rules and regulations now, or hereafter, promulgated by the State Revenue

Commissioner underthe authority ofsaid Act, as amended, for the enforcementand administration of said Act, and with such other conditions as the State Revenue

Commissioner may require in rules and regulations, then this bond shall be void; otherwise, it shall remain of full force and effect and shall be construed as a bond

of forfeiture.

This bond may be cancelled by the Principal, the Surety or the Obligee by giving sixty (60) days’ notice in writing to each of the other parties hereto at their last

known address, but no such cancellation shall affect the liability of either the Principal or the Surety occurring before the expiration date of such notice.

This bond shall be in force for the period beginning on the

day of

_______,through the 30th day of June,

_____

________________________,

________

inclusive, and shall not be construed as a renewal orcontinuation of any other bond executed by said Principal and Surety to Obligee for any other period.

IN WITNESS WHEREOF, the said Principal has hereunto set his hand and affixed his seal, and the said Surety has caused these presents to be duly executed

by its duly authorized officials, or its duly authorized attomey in fact, and its corporate seal to be hereunto affixed, the day and year first above written.

COUNTERSIGNED

PRINCIPAL_______________________________________ (L.S.)

____________________________________

(Local Agent)

(Signature of Licensee I Authorized Corporate Officer)

(Address)

SURETY

______________________________________

__________________________________________

(Attorney in Fact)

(City)

(State)

(Zip Code)

NOTE: The official orattorney in fact signing for Surety shall attach to the original bond a certified copy of authority or power to bind the Surety. It shall show that the

power is in force and effect at the time of the execution of the bond.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1