Child Support Determination Form

ADVERTISEMENT

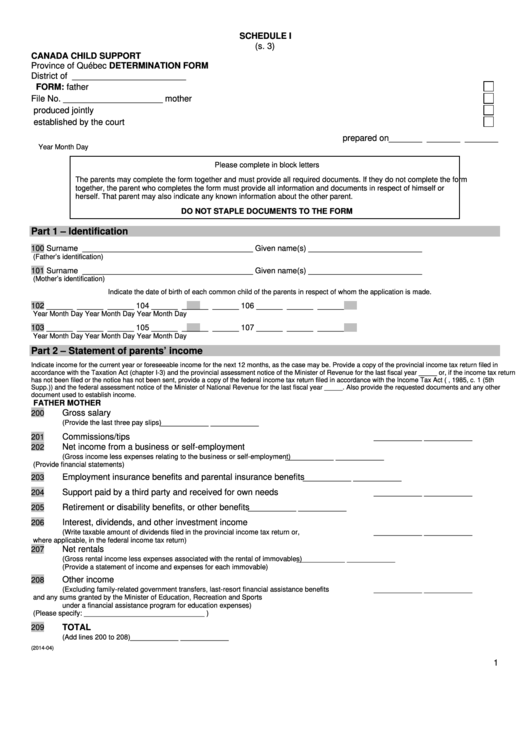

SCHEDULE I

(s. 3)

CANADA

CHILD SUPPORT

Province of Québec

DETERMINATION FORM

District of ________________________

FORM:

father

File No. _____________________

mother

produced jointly

established by the court

prepared on_______ _______ _______

Year

Month

Day

Please complete in block letters

The parents may complete the form together and must provide all required documents. If they do not complete the form

together, the parent who completes the form must provide all information and documents in respect of himself or

herself. That parent may also indicate any known information about the other parent.

DO NOT STAPLE DOCUMENTS TO THE FORM

Part 1 – Identification

100

Surname _______________________________________

Given name(s) __________________________

(Father’s identification)

101

Surname _______________________________________

Given name(s) __________________________

(Mother’s identification)

Indicate the date of birth of each common child of the parents in respect of whom the application is made.

102

______ ______ ______

104

______ ______ ______

106

______ ______ ______

Year

Month

Day

Year

Month

Day

Year

Month

Day

103

______ ______ ______

105

______ ______ ______

107

______ ______ ______

Year

Month

Day

Year

Month

Day

Year

Month

Day

Part 2 – Statement of parents’ income

Indicate income for the current year or foreseeable income for the next 12 months, as the case may be. Provide a copy of the provincial income tax return filed in

accordance with the Taxation Act (chapter I-3) and the provincial assessment notice of the Minister of Revenue for the last fiscal year _____ or, if the income tax return

has not been filed or the notice has not been sent, provide a copy of the federal income tax return filed in accordance with the Income Tax Act (R.S.C., 1985, c. 1 (5th

Supp.)) and the federal assessment notice of the Minister of National Revenue for the last fiscal year _____. Also provide the requested documents and any other

document used to establish income.

FATHER

MOTHER

Gross salary

200

___________

___________

(Provide the last three pay slips)

Commissions/tips

201

___________

___________

Net income from a business or self-employment

202

___________

___________

(Gross income less expenses relating to the business or self-employment)

(Provide financial statements)

Employment insurance benefits and parental insurance benefits

203

___________

___________

Support paid by a third party and received for own needs

204

___________

___________

Retirement or disability benefits, or other benefits

205

___________

___________

Interest, dividends, and other investment income

206

___________

___________

(Write taxable amount of dividends filed in the provincial income tax return or,

where applicable, in the federal income tax return)

Net rentals

207

___________

___________

(Gross rental income less expenses associated with the rental of immovables)

(Provide a statement of income and expenses for each immovable)

Other income

208

___________

___________

(Excluding family-related government transfers, last-resort financial assistance benefits

and any sums granted by the Minister of Education, Recreation and Sports

under a financial assistance program for education expenses)

(Please specify: _______________________________ )

TOTAL

209

___________

___________

(Add lines 200 to 208)

(2014-04)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7