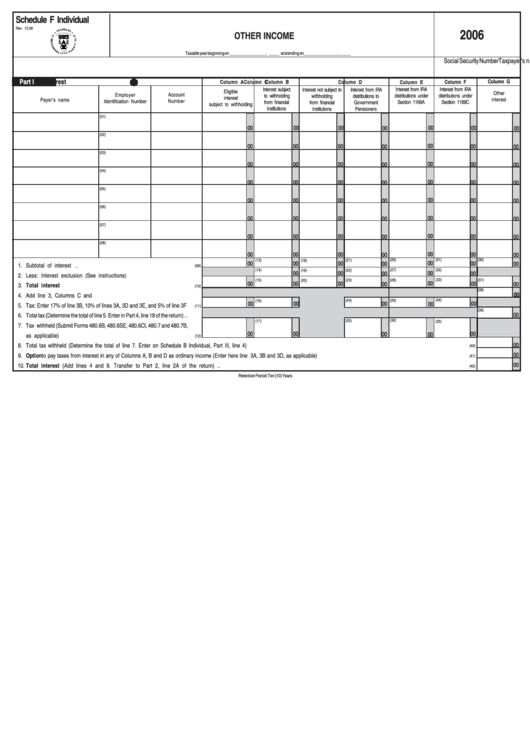

Schedule F Individual - Other Income - 2006

ADVERTISEMENT

Schedule F Individual

Rev. 12.06

2006

OTHER INCOME

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Social Security Number

Part I

Interest

Column G

Column A

Column B

Column C

Column D

Column E

Column F

31

Interest from IRA

Interest from IRA

Interest subject

Interest not subject to

Interest from IRA

Eligible

Other

Employer

Account

to withholding

distributions under

distributions under

withholding

distributions to

interest

Payer's name

interest

Identification Number

Number

from financial

Section 1169A

Section 1169C

from financial

Government

subject to withholding

institutions

institutions

Pensioners

(01)

00

00

00

00

00

00

00

(02)

00

00

00

00

00

00

00

(03)

00

00

00

00

00

00

00

(04)

00

00

00

00

00

00

00

(05)

00

00

00

00

00

00

00

(06)

00

00

00

00

00

00

00

(07)

00

00

00

00

00

00

00

(08)

00

00

00

00

00

00

00

(26)

(31)

(36)

(13)

(18)

(21)

00

00

00

00

00

00

00

1.

Subtotal of interest ...................

................................................................

..

(09)

(32)

(14)

(22)

(27)

(19)

00

00

00

00

00

2.

Less: Interest exclusion

See instructions

(

) ....................................................

(15)

(23)

(28)

(33)

(37)

(20)

00

00

00

00

00

00

00

3.

Total interest .........................................................................................

(10)

(38)

00

00

Add line 3, Columns C and G.....................................................................

4.

(29)

(34)

(16)

(24)

00

00

00

00

00

5.

Tax: Enter 17% of line 3B, 10% of lines 3A, 3D and 3E, and 5% of line 3F ....

(11)

(39)

00

6.

Total tax (Determine the total of line 5. Enter in Part 4, line 18 of the return) ..

......

(25)

(30)

(17)

(35)

7.

Tax withheld (Submit Forms 480.6B, 480.6SE, 480.6CI, 480.7 and 480.7B,

00

00

00

00

00

as applicable) ..........................................................................................

(12)

00

8.

Total tax withheld (Determine the total of line 7. Enter on Schedule B Individual, Part IIl, line 4)............................................................................................................................................................

......

(40)

00

9.

Option to pay taxes from interest in any of Columns A, B and D as ordinary income (Enter here line 3A, 3B and 3D, as applicable) ..........................................................................................................

(41)

......

.

00

10.

Total interest (Add lines 4 and 9. Transfer to Part 2, line 2A of the return)........................................................

.

..............................................................................................................................

(42)

Retention Period: Ten (10) Years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3