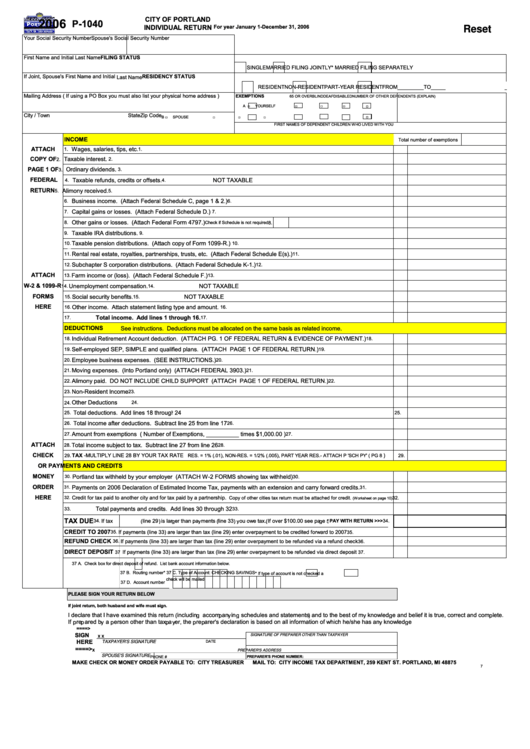

CITY OF PORTLAND

2006

P-1040

For year January 1-December 31, 2006

INDIVIDUAL RETURN

Reset

Your Social Security Number

Spouse's Social Security Number

First Name and Initial

Last Name

FILING STATUS

SINGLE

MARRIED FILING JOINTLY

* MARRIED FILING SEPARATELY

If Joint, Spouse's First Name and Initial

RESIDENCY STATUS

Last Name

RESIDENT

NON-RESIDENT

PART-YEAR RESIDENT

FROM_________TO______

Mailing Address ( If using a PO Box you must also list your physical home address )

EXEMPTIONS

65 OR OVER

BLIND

DEAF

DISABLED

NUMBER OF OTHER DEPENDENTS (EXPLAIN)

□

A

□

YOURSELF

□

□

□

City / Town

State

Zip Code

B

□

SPOUSE

□

□

□

□

FIRST NAMES OF DEPENDENT CHILDREN WHO LIVED WITH YOU

INCOME

Total number of exemptions

ATTACH

Wages, salaries, tips, etc.

1.

1.

COPY OF

Taxable interest.

2.

2.

PAGE 1 OF

Ordinary dividends.

3.

3.

FEDERAL

Taxable refunds, credits or offsets.

NOT TAXABLE

4.

4.

RETURN

Alimony received.

5.

5.

Business income. (Attach Federal Schedule C, page 1 & 2.)

6.

6.

Capital gains or losses. (Attach Federal Schedule D.)

7.

7.

Other gains or losses. (Attach Federal Form 4797.)

8.

Check if Schedule is not required

8.

Taxable IRA distributions.

9.

9.

Taxable pension distributions. (Attach copy of Form 1099-R.)

10.

10.

Rental real estate, royalties, partnerships, trusts, etc. (Attach Federal Schedule E(s).)

11.

11.

Subchapter S corporation distributions. (Attach Federal Schedule K-1.)

12.

12.

ATTACH

Farm income or (loss). (Attach Federal Schedule F.)

13.

13.

W-2 & 1099-R

14.

Unemployment compensation.

14.

NOT TAXABLE

FORMS

Social security benefits.

NOT TAXABLE

15.

15.

HERE

Other income. Attach statement listing type and amount.

16.

16.

Total income. Add lines 1 through 16.

17.

17.

DEDUCTIONS

See instructions. Deductions must be allocated on the same basis as related income.

Individual Retirement Account deduction. (ATTACH PG. 1 OF FEDERAL RETURN & EVIDENCE OF PAYMENT.)

18.

18.

Self-employed SEP, SIMPLE and qualified plans. (ATTACH PAGE 1 OF FEDERAL RETURN.)

19.

19.

Employee business expenses. (SEE INSTRUCTIONS.)

20.

20.

Moving expenses. (Into Portland only) (ATTACH FEDERAL 3903.)

21.

21.

Alimony paid. DO NOT INCLUDE CHILD SUPPORT (ATTACH PAGE 1 OF FEDERAL RETURN.)

22.

22.

Non-Resident Income

23.

23.

Other Deductions

24.

24.

Total deductions. Add lines 18 through24

25.

25.

Total income after deductions. Subtract line 25 from line 17

26.

26.

Amount from exemptions ( Number of Exemptions, __________ times $1,000.00 )

27.

27.

ATTACH

Total income subject to tax. Subtract line 27 from line 26

28.

28.

CHECK

29.

TAX -MULTIPLY LINE 28 BY YOUR TAX RATE

RES. = 1% (.01), NON-RES. = 1/2% (.005), PART YEAR RES.- ATTACH P 'SCH PY' ( PG 8

)

29.

OR

PAYMENTS AND CREDITS

MONEY

Portland tax withheld by your employer (ATTACH W-2 FORMS showing tax withheld)

30.

30.

ORDER

Payments on 2006 Declaration of Estimated Income Tax, payments with an extension and carry forward credits.

31.

31.

HERE

Credit for tax paid to another city and for tax paid by a partnership.

32.

Copy of other cities tax return must be attached for credit.

32.

(Worksheet on page 10)

Total payments and credits. Add lines 30 through 32

33.

33.

TAX DUE

34.

If tax (line 29) is larger than payments (line 33) you owe tax.(If over $100.00 see page 5

34.

PAY WITH RETURN >>>

CREDIT TO 2007

35.

If payments (line 33) are larger than tax (line 29) enter overpayment to be credited forward to 2007

35.

REFUND CHECK

36.

If payments (line 33) are larger than tax (line 29) enter overpayment to be refunded via a refund check

36.

DIRECT DEPOSIT

37

If payments (line 33) are larger than tax (line 29) enter overpayment to be refunded via direct deposit

37.

37 A.

Check box for direct deposit of refund. List bank account information below.

37 B. Routing number

* 37 C. Type of Account:

CHECKING

SAVINGS * If type of account is not checked a

check will be mailed

37 D. Account number

PLEASE SIGN YOUR RETURN BELOW

If joint return, both husband and wife must sign.

I declare that I have examined this return (including accompanying schedules and statements) and to the best of my knowledge and belief it is true, correct and complete.

If prepared by a person other than taxpayer, the preparer's declaration is based on all information of which he/she has any knowledge

====>

SIGN

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

X X

HERE

DATE

TAXPAYER'S SIGNATURE

====>

X

PREPARER'S ADDRESS

SPOUSE'S SIGNATURE

PHONE #

PREPARER'S PHONE NUMBER:

MAKE CHECK OR MONEY ORDER PAYABLE TO: CITY TREASURER

MAIL TO: CITY INCOME TAX DEPARTMENT, 259 KENT ST. PORTLAND, MI 48875

7

1

1 2

2