Application For Business, Sales/use Tax, Lodgers Tax Licenses And Occupational Privilege Tax Registration Form

ADVERTISEMENT

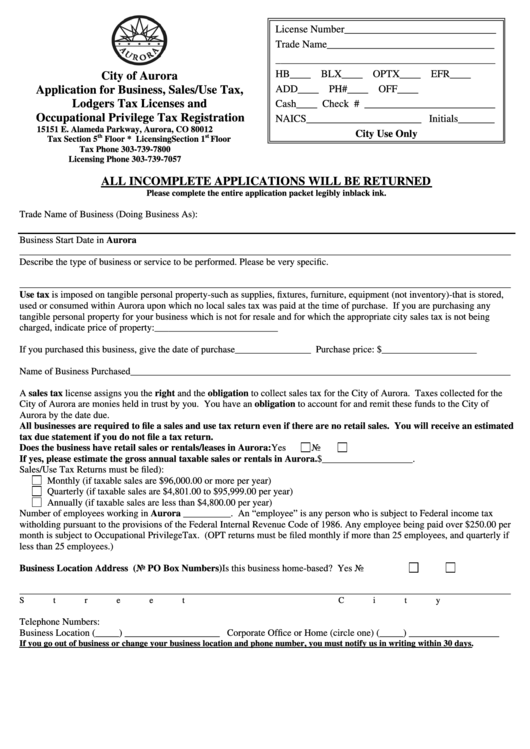

License Number_____________________________

Trade Name________________________________

__________________________________________

HB____ BLX____ OPTX____ EFR____

City of Aurora

Application for Business, Sales/Use Tax,

ADD____ PH#____ OFF____

Lodgers Tax Licenses and

Cash____ Check # _________________________

Occupational Privilege Tax Registration

NAICS______________________ Initials_______

15151 E. Alameda Parkway, Aurora, CO 80012

City Use Only

th

st

Tax Section 5

Floor * Licensing Section 1

Floor

Tax Phone 303-739-7800

Licensing Phone 303-739-7057

ALL INCOMPLETE APPLICATIONS WILL BE RETURNED

Please complete the entire application packet legibly in black ink.

Trade Name of Business (Doing Business As):

Business Start Date in Aurora

_______________________________________________________________________________________________________

Describe the type of business or service to be performed. Please be very specific.

_______________________________________________________________________________________________________

Use tax is imposed on tangible personal property-such as supplies, fixtures, furniture, equipment (not inventory)-that is stored,

used or consumed within Aurora upon which no local sales tax was paid at the time of purchase. If you are purchasing any

tangible personal property for your business which is not for resale and for which the appropriate city sales tax is not being

charged, indicate price of property:__________________________

If you purchased this business, give the date of purchase________________ Purchase price: $____________________

Name of Business Purchased________________________________________________________________________________

A sales tax license assigns you the right and the obligation to collect sales tax for the City of Aurora. Taxes collected for the

City of Aurora are monies held in trust by you. You have an obligation to account for and remit these funds to the City of

Aurora by the date due.

All businesses are required to file a sales and use tax return even if there are no retail sales. You will receive an estimated

tax due statement if you do not file a tax return.

Does the business have retail sales or rentals/leases in Aurora:

Yes

No

If yes, please estimate the gross annual taxable sales or rentals in Aurora. $___________________.

Sales/Use Tax Returns must be filed):

Monthly (if taxable sales are $96,000.00 or more per year)

Quarterly (if taxable sales are $4,801.00 to $95,999.00 per year)

Annually (if taxable sales are less than $4,800.00 per year)

Number of employees working in Aurora __________. An “employee” is any person who is subject to Federal income tax

witholding pursuant to the provisions of the Federal Internal Revenue Code of 1986. Any employee being paid over $250.00 per

month is subject to Occupational Privilege Tax. (OPT returns must be filed monthly if more than 25 employees, and quarterly if

less than 25 employees.)

Business Location Address (No PO Box Numbers)

Is this business home-based?

Yes

No

_______________________________________________________________________________________________________

Street

City

State

Zip

Telephone Numbers:

Business Location (_____) ____________________

Corporate Office or Home (circle one) (_____) ___________________

If you go out of business or change your business location and phone number, you must notify us in writing within 30 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3