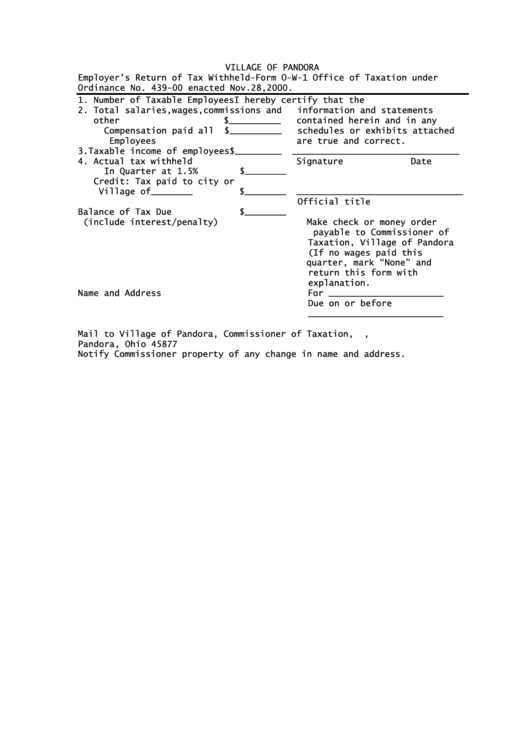

Form O-W-1 - Return Of Tax Withheld

ADVERTISEMENT

VILLAGE OF PANDORA

Employer’s Return of Tax Withheld-Form O-W-1 Office of Taxation under

Ordinance No. 439-00 enacted Nov.28,2000.

1. Number of Taxable Employees

I hereby certify that the

2. Total salaries,wages,commissions and

information and statements

other

$__________

contained herein and in any

Compensation paid all

$__________

schedules or exhibits attached

Employees

are true and correct.

3. Taxable income of employees$_________

________________________________

4. Actual tax withheld

Signature

Date

In Quarter at 1.5%

$________

Credit: Tax paid to city or

Village of________

$________

________________________________

Official title

Balance of Tax Due

$________

(include interest/penalty)

Make check or money order

payable to Commissioner of

Taxation, Village of Pandora

(If no wages paid this

quarter, mark “None” and

return this form with

explanation.

Name and Address

For ______________________

Due on or before

__________________________

Mail to Village of Pandora, Commissioner of Taxation, P.O. Box 193,

Pandora, Ohio 45877

Notify Commissioner property of any change in name and address.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1