Print and Reset Form

Reset Form

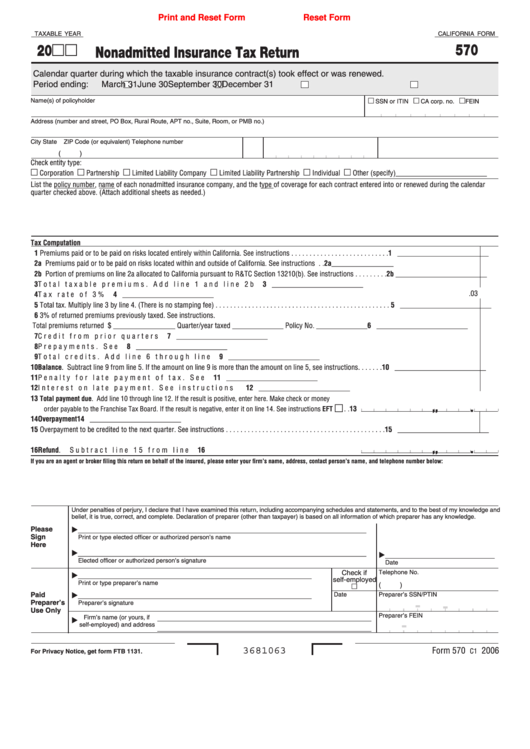

TAXABLE YEAR

CALIFORNIA FORM

570

20

Nonadmitted Insurance Tax Return

Calendar quarter during which the taxable insurance contract(s) took effect or was renewed.

Period ending:

March 31

June 30

September 30

December 31

Name(s) of policyholder

SSN or ITIN

CA corp. no.

FEIN

Address (number and street, PO Box, Rural Route, APT no., Suite, Room, or PMB no.)

City

State ZIP Code (or equivalent)

Telephone number

( )

Check entity type:

Corporation

Partnership

Limited Liability Company

Limited Liability Partnership

Individual

Other (specify)_________________________

List the policy number, name of each nonadmitted insurance company, and the type of coverage for each contract entered into or renewed during the calendar

quarter checked above. (Attach additional sheets as needed.)

Tax Computation

1 Premiums paid or to be paid on risks located entirely within California. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 _________________________

2 a Premiums paid or to be paid on risks located within and outside of California. See instructions . .2a_________________

2 b Portion of premiums on line 2a allocated to California pursuant to R&TC Section 13210(b). See instructions . . . . . . . . . 2b _________________________

3 Total taxable premiums. Add line 1 and line 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 _________________________

.03

4 Tax rate of 3% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 _________________________

5 Total tax. Multiply line 3 by line 4. (There is no stamping fee) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 _________________________

6 3% of returned premiums previously taxed. See instructions.

Total premiums returned $ _________________ Quarter/year taxed ______________ Policy No. ______________ . . . . 6 _________________________

7 Credit from prior quarters . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 _________________________

8 Prepayments. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 _________________________

9 Total credits. Add line 6 through line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 _________________________

10 Balance. Subtract line 9 from line 5. If the amount on line 9 is more than the amount on line 5, see instructions. . . . . . . 10 _________________________

11 Penalty for late payment of tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 _________________________

12 Interest on late payment. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 _________________________

13

Total payment due. Add line 10 through line 12. If the result is positive, enter here. Make check or money

n

.

,

,

. .13

order payable to the Franchise Tax Board. If the result is negative, enter it on line 14. See instructions EFT

14 Overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 _________________________

15 Overpayment to be credited to the next quarter. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 _________________________

.

,

,

16 Refund. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16

If you are an agent or broker filing this return on behalf of the insured, please enter your firm’s name, address, contact person’s name, and telephone number below:

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

_______________________________________________________________________________

Sign

Print or type elected officer or authorized person’s name

Here

_______________________________________________________________________________

______________________________

Elected officer or authorized person’s signature

Date

Check if

Telephone No.

________________________________________________________________

self-employed

Print or type preparer’s name

( )

Paid

________________________________________________________________

Date

Preparer’s SSN/PTIN

-

-

Preparer’s

Preparer’s signature

Use Only

Preparer’s FEIN

Firm’s name (or yours, if

-

self-employed) and address

3681063

Form 570

2006

C1

For Privacy Notice, get form FTB 1131.

1

1