Form Ww-1 - Employer'S Quarterly Return Of Tax Withheld

ADVERTISEMENT

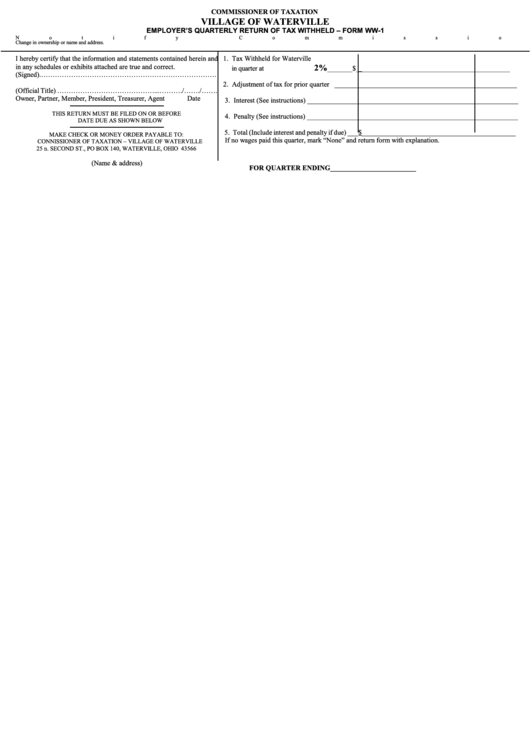

COMMISSIONER OF TAXATION

VILLAGE OF WATERVILLE

EMPLOYER’S QUARTERLY RETURN OF TAX WITHHELD – FORM WW-1

Notify Commissioner promptly of any

Change in ownership or name and address.

I hereby certify that the information and statements contained herein and

1. Tax Withheld for Waterville

in any schedules or exhibits attached are true and correct.

2%

in quarter at

_______$___________________________________________

(Signed).………………………………………………………………….

2. Adjustment of tax for prior quarter ___________________________________________________

(Official Title) ……………………………………...………./……./…….

Owner, Partner, Member, President, Treasurer, Agent

Date

3. Interest (See instructions) ___________________________________________________________

THIS RETURN MUST BE FILED ON OR BEFORE

4. Penalty (See instructions) ___________________________________________________________

DATE DUE AS SHOWN BELOW

5. Total (Include interest and penalty if due) ___$___________________________________________

MAKE CHECK OR MONEY ORDER PAYABLE TO:

If no wages paid this quarter, mark “None” and return form with explanation.

CONNISSIONER OF TAXATION – VILLAGE OF WATERVILLE

25 n. SECOND ST., PO BOX 140, WATERVILLE, OHIO 43566

(Name & address)

FOR QUARTER ENDING________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1