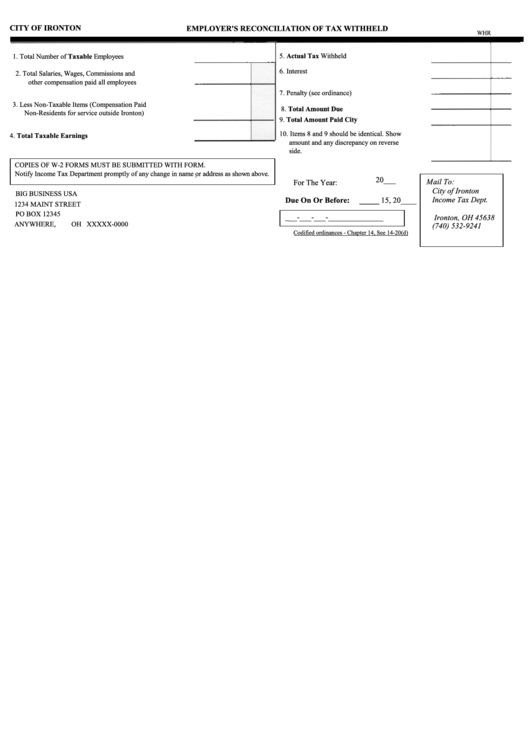

Employer'S Reconciliation Of Tax Withheld Form

ADVERTISEMENT

CITY OF IRONTON

EMPLOYER'S RECONCILIATION OF TAX WITHHELD

WHR

5. Actual Tax Withheld

1. Total Number of Taxable Employees

6. Interest

2. Total Salaries, Wages, Commissions and

other compensation paid all employees

7. Penalty (see ordinance)

3. Less Non-Taxable Items (Compensation Paid

8. Total Amount Due

Non-Residents for service outside Ironton)

9. Total Amount Paid City

10. Items 8 and 9 should be identical. Show

4. Total Taxable Earnings

amount and any discrepancy on reverse

side.

COPIES OF W-2 FORMS MUST BE SUBMITTED WITH FORM.

Notify Income Tax Department promptly of any change in name or address as shown above.

20___

Mail To:

For The Year:

City of Ironton

BIG BUSINESS USA

Income Tax Dept.

Due On Or Before:

_____ 15, 20____

1234 MAINT STREET

P.O. Box 704

PO BOX 12345

___-___-___-______________

Ironton, OH 45638

ANYWHERE,

OH XXXXX-0000

(740) 532-9241

Codified ordinances - Chapter 14, See 14-20(d)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1