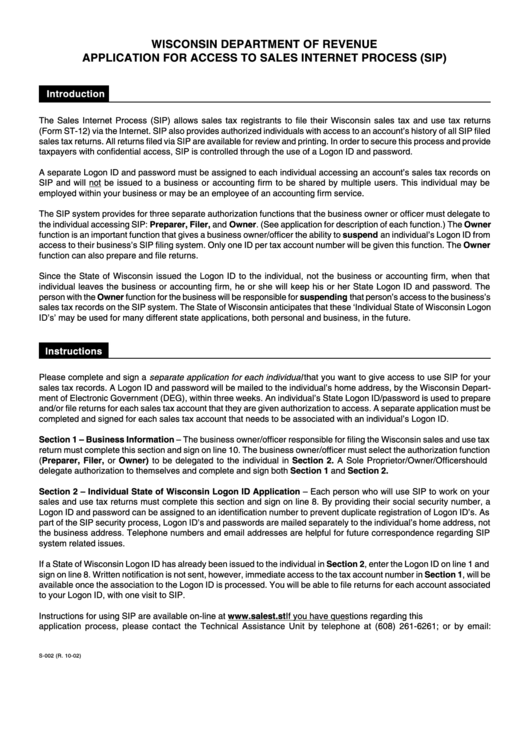

Form S-002 - Application For Access To Sales Internet Process - Wisconsin Department Of Revenue

ADVERTISEMENT

WISCONSIN DEPARTMENT OF REVENUE

APPLICATION FOR ACCESS TO SALES INTERNET PROCESS (SIP)

Introduction

The Sales Internet Process (SIP) allows sales tax registrants to file their Wisconsin sales tax and use tax returns

(Form ST-12) via the Internet. SIP also provides authorized individuals with access to an account’s history of all SIP filed

sales tax returns. All returns filed via SIP are available for review and printing. In order to secure this process and provide

taxpayers with confidential access, SIP is controlled through the use of a Logon ID and password.

A separate Logon ID and password must be assigned to each individual accessing an account’s sales tax records on

SIP and will not be issued to a business or accounting firm to be shared by multiple users. This individual may be

employed within your business or may be an employee of an accounting firm service.

The SIP system provides for three separate authorization functions that the business owner or officer must delegate to

the individual accessing SIP: Preparer, Filer, and Owner. (See application for description of each function.) The Owner

function is an important function that gives a business owner/officer the ability to suspend an individual’s Logon ID from

access to their business’s SIP filing system. Only one ID per tax account number will be given this function. The Owner

function can also prepare and file returns.

Since the State of Wisconsin issued the Logon ID to the individual, not the business or accounting firm, when that

individual leaves the business or accounting firm, he or she will keep his or her State Logon ID and password. The

person with the Owner function for the business will be responsible for suspending that person’s access to the business’s

sales tax records on the SIP system. The State of Wisconsin anticipates that these ‘Individual State of Wisconsin Logon

ID’s’ may be used for many different state applications, both personal and business, in the future.

Instructions

Please complete and sign a separate application for each individual that you want to give access to use SIP for your

sales tax records. A Logon ID and password will be mailed to the individual’s home address, by the Wisconsin Depart-

ment of Electronic Government (DEG), within three weeks. An individual’s State Logon ID/password is used to prepare

and/or file returns for each sales tax account that they are given authorization to access. A separate application must be

completed and signed for each sales tax account that needs to be associated with an individual’s Logon ID.

Section 1 – Business Information – The business owner/officer responsible for filing the Wisconsin sales and use tax

return must complete this section and sign on line 10. The business owner/officer must select the authorization function

(Preparer, Filer, or Owner) to be delegated to the individual in Section 2. A Sole Proprietor/Owner/Officer should

delegate authorization to themselves and complete and sign both Section 1 and Section 2.

Section 2 – Individual State of Wisconsin Logon ID Application – Each person who will use SIP to work on your

sales and use tax returns must complete this section and sign on line 8. By providing their social security number, a

Logon ID and password can be assigned to an identification number to prevent duplicate registration of Logon ID’s. As

part of the SIP security process, Logon ID’s and passwords are mailed separately to the individual’s home address, not

the business address. Telephone numbers and email addresses are helpful for future correspondence regarding SIP

system related issues.

If a State of Wisconsin Logon ID has already been issued to the individual in Section 2, enter the Logon ID on line 1 and

sign on line 8. Written notification is not sent, however, immediate access to the tax account number in Section 1, will be

available once the association to the Logon ID is processed. You will be able to file returns for each account associated

to your Logon ID, with one visit to SIP.

Instructions for using SIP are available on-line at . If you have questions regarding this

application process, please contact the Technical Assistance Unit by telephone at (608) 261-6261; or by email:

sales10@dor.state.wi.us

S-002 (R. 10-02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2