Tr-3 - Application For Refund Of Tire Fee

ADVERTISEMENT

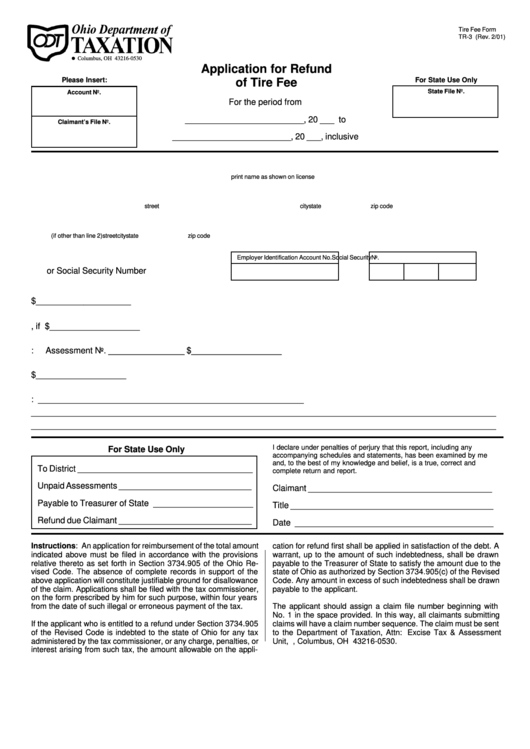

Tire Fee Form

TR-3 (Rev. 2/01)

P.O. Box 530= Columbus, OH 43216-0530

Application for Refund

Please Insert:

For State Use Only

of Tire Fee

State File No.

Account No.

For the period from

_________________________, 20 ___ to

Claimant’s File No.

_________________________, 20 ___, inclusive

1. Name __________________________________________________________________________________________

print name as shown on license

2. Business Address ________________________________________________________________________________

street

city

state

zip code

3. Mailing Address __________________________________________________________________________________

(if other than line 2)

street

city

state

zip code

4. Federal Employer Identification Account No.

Employer Identification Account No.

Social SecurityNo.

or Social Security Number

5. By an illegal or erroneous payment to Treasurer of State ........................................................ $ ____________________

6. Less discount, if applicable ..................................................................................................... $ ___________________

7. By an illegal or erroneous assessment:

Assessment No. ________________ .................... $ ___________________

10. Total Amount of Claim ............................................................................................................. $ ___________________

11. State full and complete reasons for above claim: ________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

I declare under penalties of perjury that this report, including any

For State Use Only

accompanying schedules and statements, has been examined by me

and, to the best of my knowledge and belief, is a true, correct and

To District _____________________________________

complete return and report.

Unpaid Assessments ____________________________

Claimant _______________________________________

Payable to Treasurer of State _____________________

Title ___________________________________________

Refund due Claimant ____________________________

Date __________________________________________

Instructions: An application for reimbursement of the total amount

cation for refund first shall be applied in satisfaction of the debt. A

indicated above must be filed in accordance with the provisions

warrant, up to the amount of such indebtedness, shall be drawn

relative thereto as set forth in Section 3734.905 of the Ohio Re-

payable to the Treasurer of State to satisfy the amount due to the

vised Code. The absence of complete records in support of the

state of Ohio as authorized by Section 3734.905(c) of the Revised

above application will constitute justifiable ground for disallowance

Code. Any amount in excess of such indebtedness shall be drawn

of the claim. Applications shall be filed with the tax commissioner,

payable to the applicant.

on the form prescribed by him for such purpose, within four years

from the date of such illegal or erroneous payment of the tax.

The applicant should assign a claim file number beginning with

No. 1 in the space provided. In this way, all claimants submitting

If the applicant who is entitled to a refund under Section 3734.905

claims will have a claim number sequence. The claim must be sent

of the Revised Code is indebted to the state of Ohio for any tax

to the Department of Taxation, Attn: Excise Tax & Assessment

administered by the tax commissioner, or any charge, penalties, or

Unit, P.O. Box 530, Columbus, OH 43216-0530.

interest arising from such tax, the amount allowable on the appli-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1