OMB NO. 1513-0122 (06/30/2012)

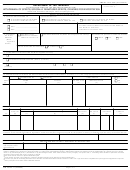

6. QUANTITATIVE LIST OF INGREDIENTS (Continued):

7. METHOD OF MANUFACTURE / PROCESS OF PRODUCTION (Continued):

proprietor product number (if none, so indicate),

GENERAL INSTRUCTIONS

drawback formula number (if none, so indicate), city

Every person who is required to file a formula under 27 CFR Parts 4, 5, 7,

and state of the flavor manufacturer, date of approval of

19, 24, 25, and 26 must submit this form to the Advertising, Labeling, and

the nonbeverage formula, alcohol content of the flavor or

Formulation Division, Alcohol and Tobacco Tax and Trade Bureau, 1310 G

blender (if nonalcoholic, so indicate), and a description of

St., NW, Washington, D.C. 20220. Permit approval and formula approval

any coloring material contained in the flavor or blender.

are required prior to manufacture/importation of any product requiring a

(d)

Identify all allergens added directly to the product or

formula. Production may commence upon receipt by the proprietor of an

contained in the flavor materials. Allergens may include

approved formula on TTB F 5100.51.

Crustacean shellfish, fish, soy (soybean(s), soya), wheat,

The number of copies to be filed is as follows: one copy for TTB’s records,

milk, eggs, peanuts, or tree nuts. For shellfish and tree

and either one additional copy, or one additional copy for each facility

nuts, the label and formula must indicate the specific type

identified in Item 1.

or species.

If the formula is approved, one copy will be retained by TTB and the

(e)

Identify the use of any artificial sweeteners.

remaining approved copy(ies) will be sent to the addressee. The addressee

will forward approved copies (or two-sided reproductions) to each facility

Distilled Spirits only:

identified in Item 1.

(f)

If any type of wine (including vermouth) is to be used in

SPECIFIC INSTRUCTIONS

the product, state the kind, percentage of wine to be used,

Formula # and Formula Superseded.

whether the wine is domestic or imported, whether the

Number the formulas in sequence commencing with the number

wine contains added wine spirits, and the percentage of

“1.” An applicant who has more than one facility must use a

alcohol by volume of the wine, and the amount of alcohol

unique system of serial numbers that does not duplicate any

contributed to the final product on a proof gallon basis.

formula number used at any plant. If this formula will supersede a

(g)

If the finished product is to be labeled as containing a

previous approved formula with the same formula number, please

particular class and type of distilled spirits (such as

check the box.

“Blackberry Liqueur & Brandy” or “Coffee Liqueur & Non-

Item 1.

Enter the name and complete address of the applicant or

Dairy Creamer”) the ingredients used to produce the

importer, and the city and state for all other facilities where the

particular class and type of distilled spirits must be listed

product will be produced if the product is produced domestically.

in a manner so that they are distinguishable from the

remaining ingredients for the finished product.

Item 1a. (For Domestic Products) Enter the complete mailing address of

the applicant if different than the information in Item 1.

Item 7.

Show in sequence each step employed in producing the product

(For Imported Products) Enter the complete name and mailing

including the step at which the specified materials will be added

address of the foreign producer.

and the approximate period of time to complete production.

Item 2.

Enter the contact person’s full phone number including area code

(For Malt Beverages) Describe in detail each special process

and extension, if necessary.

used to produce a beer product. Omit processes customarily

used in brewing such as pasteurization or ordinary filtration.

Item 3.

Enter the plant registry/basic permit/brewer’s notice number for each

facility that will produce or import the product.

Item 8.

Enter the total yield of the finished product, e.g., 150 gallons,

1500 gallons, 150 barrels.

Item 4.

The class and type must conform to one of the class and type

Item 9.

If the product is to be bottled at more than one alcohol content

designations in the regulations issued under the Federal Alcohol

within the same tax rate, state the alcoholic content as a range to

Administration Act. Wine products containing less than 7 percent

include all alcoholic contents at which the product will be bottled,

alcohol by volume must be designated in accordance with the

provided that the product does not change class and type.

labeling regulations 27 CFR Part 24 and the Federal Food, Drug

and Cosmetic Act, 21 CFR. Do not show a

name

Item 9a. (For Malt Beverages) Enter the percentage of alcohol derived

item 4.

from flavors or other materials containing alcohol.

Item 5.

Enter the

name

item 5

NOT

Item 9b. (For Malt Beverages) Enter the percentage of alcohol derived

from the malt base of the product.

been chosen, leave item 5 blank.

Item 10. (For Domestic Products) Applicant is the person required to file

Item 6.

a formula under TTB regulations.

(a)

Specify the kind and quantity of each and every material

(For Imported Products) Importer is the person who imports the

or ingredient to be used in the formulation of a batch of

product.

the product, e.g., 100 gallons, 1000 gallons, 100 barrels.

CONDITIONS FOR FORMULA APPROVAL

(b)

Identify all coloring agents added directly to the product or

This approval is granted under 27 CFR Parts 4, 5, 7, 19, 24, 25, and 26 and

contained in flavor materials. Certified food colors must

does not in any way provide exemption from or waiver of the provisions of

be identified by FD&C number, for example “FD&C Yellow

the Food and Drug Administration regulations relating to the use of food and

No. 5.”

color additives in food products.

(c)

Identify flavoring or blending materials by the name of the

flavor or blender, name of the flavor or blender proprietor,

Addition of remnants or returned merchandise to a completed product made

under the same formula is permitted.

PAPERWORK REDUCTION ACT NOTICE

This request is in accordance with the Paperwork Reduction Act of 1995. We collect this information to verify your compliance with Federal laws and regulations we administer for the formulation of alcohol

beverages. The information is mandated by statute (26 U.S.C. Chapter 51) and is used to obtain a benefit. The information collected on this form must be considered confidential tax information under

26 U.S.C. 6103, and must not be disclosed to any unauthorized party under 26 U.S.C. 7213.

We estimate 2 hours as the average burden for you to complete this form depending on your individual circumstances. You may comment to us about the accuracy of this burden estimate and suggest

ways for us to reduce the burden. Address your comments or suggestions to: Reports Management Officer, Regulations and Rulings Division, Alcohol and Tobacco Tax and Trade Bureau,

Washington, DC 20220.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a current, valid OMB control number.

TTB F 5100.51 (11/2009) (TTB FORMS 5110.38, 5120.29 SUPERSEDED)

1

1 2

2