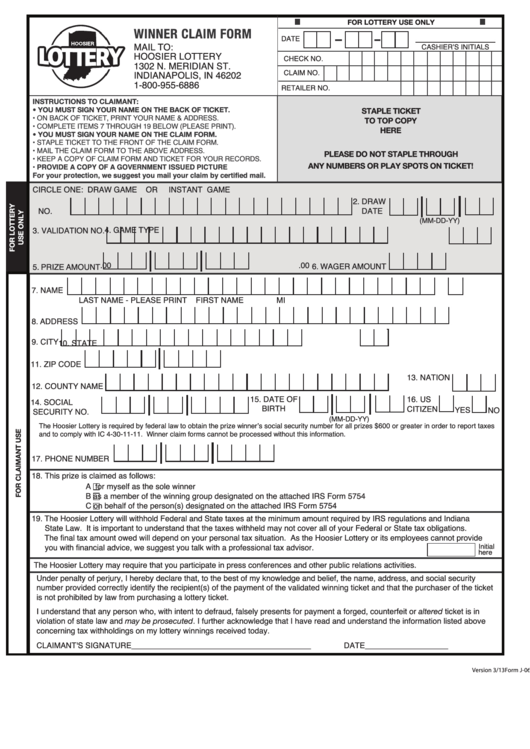

Winner Claim Form

ADVERTISEMENT

FOR LOTTERY USE ONLY

WINNER CLAIM FORM

DATE

MAIL TO:

CASHIER’S INITIALS

HOOSIER LOTTERY

CHECK NO.

1302 N. MERIDIAN ST.

CLAIM NO.

INDIANAPOLIS, IN 46202

1-800-955-6886

RETAILER NO.

INSTRUCTIONS TO CLAIMANT:

• YOU MUST SIGN YOUR NAME ON THE BACK OF TICKET.

STAPLE TICKET

• ON BACK OF TICKET, PRINT YOUR NAME & ADDRESS.

TO TOP COPY

• COMPLETE ITEMS 7 THROUGH 19 BELOW (PLEASE PRINT).

HERE

• YOU MUST SIGN YOUR NAME ON THE CLAIM FORM.

• STAPLE TICKET TO THE FRONT OF THE CLAIM FORM.

• MAIL THE CLAIM FORM TO THE ABOVE ADDRESS.

PLEASE DO NOT STAPLE THROUGH

• KEEP A COPY OF CLAIM FORM AND TICKET FOR YOUR RECORDS.

• PROVIDE A COPY OF A GOVERNMENT ISSUED PICTURE I.D.

ANY NUMBERS OR PLAY SPOTS ON TICKET!

For your protection, we suggest you mail your claim by certified mail.

CIRCLE ONE: DRAW GAME

OR

INSTANT GAME

1.TICKET

2. DRAW

NO.

DATE

(MM-DD-YY)

4. GAME TYPE

3. VALIDATION NO.

.00

.00

6. WAGER AMOUNT

5. PRIZE AMOUNT

7. NAME

LAST NAME - PLEASE PRINT

FIRST NAME

MI

8. ADDRESS

9. CITY

10. STATE

11. ZIP CODE

13. NATION

12. COUNTY NAME

15. DATE OF

16. US

14. SOCIAL

BIRTH

CITIZEN

YES

NO

SECURITY NO.

(MM-DD-YY)

The Hoosier Lottery is required by federal law to obtain the prize winner’s social security number for all prizes $600 or greater in order to report taxes

and to comply with IC 4-30-11-11. Winner claim forms cannot be processed without this information.

17. PHONE NUMBER

18. This prize is claimed as follows:

A

for myself as the sole winner

B

as a member of the winning group designated on the attached IRS Form 5754

C

on behalf of the person(s) designated on the attached IRS Form 5754

The Hoosier Lottery will withhold Federal and State taxes at the minimum amount required by IRS regulations and Indiana

19.

State Law. It is important to understand that the taxes withheld may not cover all of your Federal or State tax obligations.

The final tax amount owed will depend on your personal tax situation. As the Hoosier Lottery or its employees cannot provide

you with financial advice, we suggest you talk with a professional tax advisor.

Initial

here

The Hoosier Lottery may require that you participate in press conferences and other public relations activities.

Under penalty of perjury, I hereby declare that, to the best of my knowledge and belief, the name, address, and social security

number provided correctly identify the recipient(s) of the payment of the validated winning ticket and that the purchaser of the ticket

is not prohibited by law from purchasing a lottery ticket.

I understand that any person who, with intent to defraud, falsely presents for payment a forged, counterfeit or altered ticket is in

violation of state law and may be prosecuted. I further acknowledge that I have read and understand the information listed above

concerning tax withholdings on my lottery winnings received today.

CLAIMANT'S SIGNATURE_________________________________________

DATE___________________

Form J-06

Version 3/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1