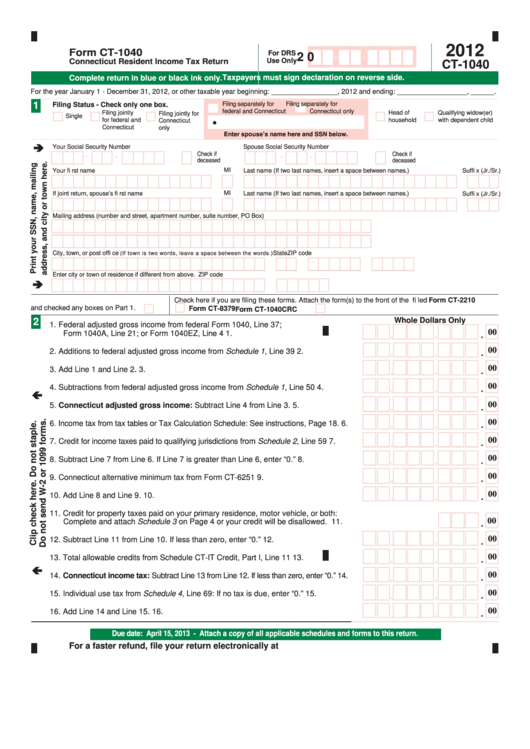

Form Ct-1040 - Connecticut Resident Income Tax Return - 2012

ADVERTISEMENT

2012

Form CT-1040

For DRS

2 0

Use Only

Connecticut Resident Income Tax Return

CT-1040

Taxpayers must sign declaration on reverse side.

Complete return in blue or black ink only.

For the year January 1 - December 31, 2012, or other taxable year beginning: _________________ , 2012 and ending: __________________, ______ .

1

Filing separately for

Filing separately for

Filing Status - Check only one box.

federal and Connecticut

Connecticut only

Filing jointly

Head of

Qualifying widow(er)

Filing jointly for

Single

for federal and

household

with dependent child

Connecticut

Connecticut

only

Enter spouse’s name here and SSN below.

Your Social Security Number

Spouse Social Security Number

-

Check if

Check if

-

-

-

deceased

deceased

MI

Your fi rst name

Last name (If two last names, insert a space between names.)

Suffi x (Jr./Sr.)

MI

If joint return, spouse’s fi rst name

Last name (If two last names, insert a space between names.)

Suffi x (Jr./Sr.)

Mailing address (number and street, apartment number, suite number, PO Box)

City, town, or post offi ce

State

ZIP code

(If town is two words, leave a space between the words.)

-

Enter city or town of residence if different from above.

ZIP code

Check if you fi led Form CT-2210

Check here if you are fi ling these forms. Attach the form(s) to the front of the return.

and checked any boxes on Part 1.

Form CT-8379

Form CT-1040CRC

2

Whole Dollars Only

1. Federal adjusted gross income from federal Form 1040, Line 37;

00

.

Form 1040A, Line 21; or Form 1040EZ, Line 4

1.

,

,

00

.

2. Additions to federal adjusted gross income from Schedule 1, Line 39

2.

,

,

.

00

3. Add Line 1 and Line 2.

3.

,

,

.

00

4. Subtractions from federal adjusted gross income from Schedule 1, Line 50

4.

,

,

00

.

5. Connecticut adjusted gross income: Subtract Line 4 from Line 3.

5.

,

,

00

.

6. Income tax from tax tables or Tax Calculation Schedule: See instructions, Page 18.

6.

,

,

00

.

7. Credit for income taxes paid to qualifying jurisdictions from Schedule 2, Line 59

7.

,

,

00

.

8. Subtract Line 7 from Line 6. If Line 7 is greater than Line 6, enter “0.”

8.

,

,

00

.

9. Connecticut alternative minimum tax from Form CT-6251

9.

,

,

00

.

10. Add Line 8 and Line 9.

10.

,

,

11. Credit for property taxes paid on your primary residence, motor vehicle, or both:

00

.

Complete and attach Schedule 3 on Page 4 or your credit will be disallowed.

11.

.

00

12. Subtract Line 11 from Line 10. If less than zero, enter “0.”

12.

,

,

.

00

13. Total allowable credits from Schedule CT-IT Credit, Part I, Line 11

13.

,

,

00

.

14. Connecticut income tax: Subtract Line 13 from Line 12. If less than zero, enter “0.”

14.

,

,

.

00

15. Individual use tax from Schedule 4, Line 69: If no tax is due, enter “0.”

15.

,

,

.

00

16. Add Line 14 and Line 15.

16.

,

,

Due date: April 15, 2013 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, fi le your return electronically at and choose direct deposit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4