Form Rf100 - Application For Refund - 2011 Page 2

ADVERTISEMENT

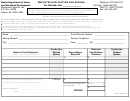

2011 REFUND INSTRUCTIONS

******IMPORTANT******

♦ Form RF100, Application for Refund must be submitted with an original signature and dated. No photocopied signatures will be

accepted. Also, W-2 forms submitted must show federal taxable, social security and medicare wages (not just local wages) and the

license tax withheld for each separate jurisdiction. Also, attach a copy of any year end earnings summary statements.

♦ The due date for employer payroll information is March 1, 2012. Therefore, to allow adequate verification of payroll amounts, refund

processing will begin after March 15, 2012. Please allow 6-8 weeks for processing.

♦ Failure to complete any or all parts of Form RF100-T will delay the processing of your refund and may result in your refund

application being returned to you.

Line 1:

Enter the “Total Gross Compensation”, the amount before any deductions, for 2011. This includes income from salaries,

wages, bonuses, severance and/or termination pay, deferred compensations and/or pension plans, cafeteria plans, etc. and

amounts received for approved leave including, but not limited to, vacation, sick or holiday pay.

NOTE: If a refund is claimed for wages earned outside of the Jurisdiction and the wages are from more than one

employer, a separate application must be completed for each employer.

Line 2:

Enter the amount from Form RF100, Calculation of Wages Earned Outside of the Jurisdiction, PART II, Line 7.

Line 3:

Deduct Line 2 from Line 1. Enter the result on Line 3.

Line 4:

Individuals 65 years of age and older, enter $10,000.00 for City and County only. All others enter zero. Please note this

exemption is for the first $10,000.00 of compensation earned in a given year.

It is not for the $10,000.00 of

compensation received from each employer during a given year. To qualify for this exemption you must enter your date

of birth in the space provided. Also, you must attach a copy of all Federal Form W-2s received for the year.

Line 5:

Deduct Line 4 from Line 3. Enter the result on Line 5.

Line 6:

Enter the actual amount of license fee withheld from your compensation for the year.

Line 8:

Multiply Line 5 by the license fee rate on Line 7. Enter the result on Line 8.

Line 9:

Deduct Line 8 from Line 6. Enter the result on Line 9. This is the amount of your refund.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4