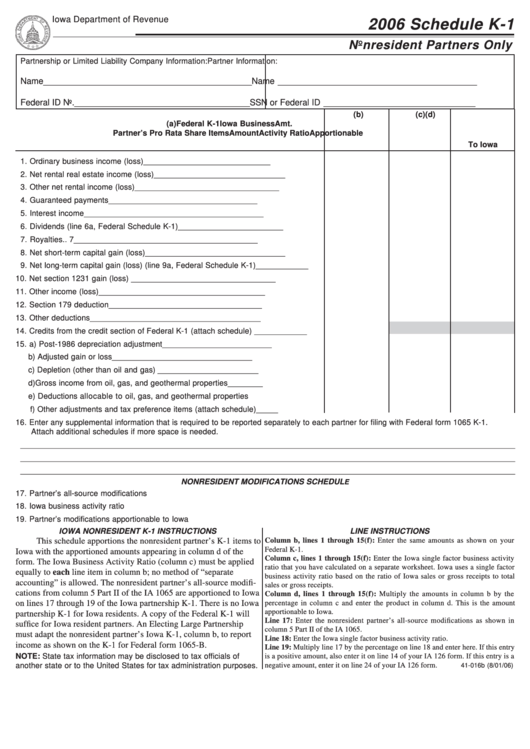

Form Ia 1065 - Schedule K-1 - Nonresident Partners Only - 2006

ADVERTISEMENT

Iowa Department of Revenue

2006 Schedule K-1

Nonresident Partners Only

Partnership or Limited Liability Company Information:

Partner Information:

Name ____________________________________________

Name __________________________________________

Federal ID No. _____________________________________

SSN or Federal ID ________________________________

(b)

(c)

(d)

(a)

Federal K-1

Iowa Business

Amt.

Partner’s Pro Rata Share Items

Amount

Activity Ratio

Apportionable

To Iowa

1. Ordinary business income (loss) ............................................................................... 1 __________________________________________

2. Net rental real estate income (loss) ........................................................................... 2 __________________________________________

3. Other net rental income (loss) .................................................................................... 3 __________________________________________

4. Guaranteed payments ................................................................................................ 4 __________________________________________

5. Interest income ........................................................................................................... 5 __________________________________________

6. Dividends (line 6a, Federal Schedule K-1) ................................................................ 6 __________________________________________

7. Royalties ..................................................................................................................... 7 __________________________________________

8. Net short-term capital gain (loss) ............................................................................... 8 __________________________________________

9. Net long-term capital gain (loss) (line 9a, Federal Schedule K-1) ............................ 9 __________________________________________

10. Net section 1231 gain (loss) .................................................................................... 10 __________________________________________

11. Other income (loss) .................................................................................................. 11 __________________________________________

12. Section 179 deduction ............................................................................................. 12 __________________________________________

13. Other deductions ...................................................................................................... 13 __________________________________________

14. Credits from the credit section of Federal K-1 (attach schedule) ........................... 14 __________________________________________

15. a) Post-1986 depreciation adjustment ................................................................... 15a __________________________________________

b) Adjusted gain or loss .......................................................................................... 15b __________________________________________

c) Depletion (other than oil and gas) .................................................................... 15c __________________________________________

d) Gross income from oil, gas, and geothermal properties ................................... 15d __________________________________________

e) Deductions allocab le to oil, gas, and geothermal properties ........................... 15e __________________________________________

f) Other adjustments and tax preference items (attach schedule) ........................ 15f __________________________________________

16. Enter any supplemental information that is required to be reported separately to each partner for filing with Federal form 1065 K-1.

Attach additional schedules if more space is needed.

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________

NONRESIDENT MODIFICATIONS SCHEDUL

E

17. Partner’s all-source modifications .................................................................................................................................... 17 _____________

18. Iowa business activity ratio .............................................................................................................................................. 18 _____________

19. Partner’s modifications apportionable to Iowa ................................................................................................................ 19 _____________

IOWA NONRESIDENT K-1 INSTRUCTIONS

LINE INSTRUCTIONS

Column b, lines 1 through 15(f): Enter the same amounts as shown on your

This schedule apportions the nonresident partner’s K-1 items to

Federal K-1.

Iowa with the apportioned amounts appearing in column d of the

Column c, lines 1 through 15(f): Enter the Iowa single factor business activity

form. The Iowa Business Activity Ratio (column c) must be applied

ratio that you have calculated on a separate worksheet. Iowa uses a single factor

equally to each line item in column b; no method of “separate

business activity ratio based on the ratio of Iowa sales or gross receipts to total

accounting” is allowed. The nonresident partner’s all-source modifi-

sales or gross receipts.

cations from column 5 Part II of the IA 1065 are apportioned to Iowa

Column d, lines 1 through 15(f): Multiply the amounts in column b by the

on lines 17 through 19 of the Iowa partnership K-1. There is no Iowa

percentage in column c and enter the product in column d. This is the amount

apportionable to Iowa.

partnership K-1 for Iowa residents. A copy of the Federal K-1 will

Line 17: Enter the nonresident partner’s all-source modifications as shown in

suffice for Iowa resident partners. An Electing Large Partnership

column 5 Part II of the IA 1065.

must adapt the nonresident partner’s Iowa K-1, column b, to report

Line 18: Enter the Iowa single factor business activity ratio.

income as shown on the K-1 for Federal form 1065-B.

Line 19: Multiply line 17 by the percentage on line 18 and enter here. If this entry

NOTE: State tax information may be disclosed to tax officials of

is a positive amount, also enter it on line 14 of your IA 126 form. If this entry is a

another state or to the United States for tax administration purposes.

negative amount, enter it on line 24 of your IA 126 form.

41-016b (8/01/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1