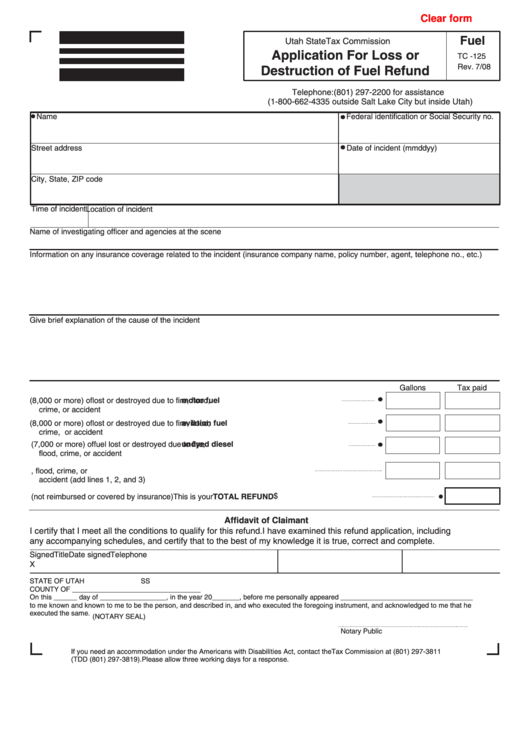

Clear form

Fuel

Utah State Tax Commission

Application For Loss or

TC -125

Rev. 7/08

Destruction of Fuel Refund

Telephone: (801) 297-2200 for assistance

(1-800-662-4335 outside Salt Lake City but inside Utah)

Name

Federal identification or Social Security no.

Street address

Date of incident (mmddyy)

City, State, ZIP code

Time of incident Location of incident

Name of investigating officer and agencies at the scene

Information on any insurance coverage related to the incident (insurance company name, policy number, agent, telephone no., etc.)

Give brief explanation of the cause of the incident

Gallons

Tax paid

1. TOTAL eligible gallons (8,000 or more) of

motor fuel

lost or destroyed due to fire, flood,

crime, or accident

2. TOTAL eligible gallons (8,000 or more) of

aviation fuel

lost or destroyed due to fire, flood,

crime, or accident

3. TOTAL eligible gallons (7,000 or more) of

undyed diesel

fuel lost or destroyed due to fire,

flood, crime, or accident

4. TOTAL of all eligible gallons of fuels lost or destroyed due to fire, flood, crime, or

accident (add lines 1, 2, and 3)

$

5. Total tax paid on gallons (not reimbursed or covered by insurance) This is your TOTAL REFUND

Affidavit of Claimant

I certify that I meet all the conditions to qualify for this refund. I have examined this refund application, including

any accompanying schedules, and certify that to the best of my knowledge it is true, correct and complete.

Signed

Date signed

Title

Telephone

X

STATE OF UTAH

SS

COUNTY OF _________________________________

On this ______ day of _________________, in the year 20_______, before me personally appeared __________________________________

to me known and known to me to be the person, and described in, and who executed the foregoing instrument, and acknowledged to me that he

executed the same.

(NOTARY SEAL)

Notary Public

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801) 297-3811

(TDD (801) 297-3819). Please allow three working days for a response.

1

1 2

2