Clear Form

For Office Use Only

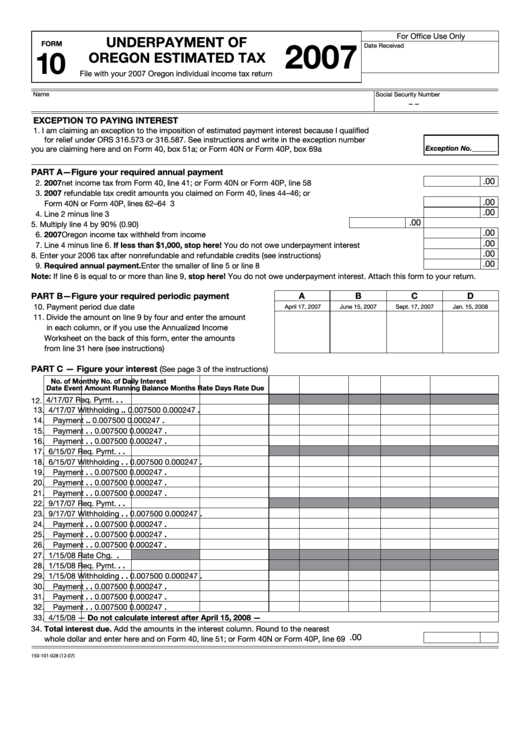

UNDERpAyMENt oF

2007

FoRM

Date Received

10

oREgoN EstIMAtED tAx

File with your 2007 Oregon individual income tax return

Name

Social Security Number

–

–

ExcEptIoN to pAyINg INtEREst

1. I am claiming an exception to the imposition of estimated payment interest because I qualified

for relief under ORS 316.573 or 316.587. See instructions and write in the exception number

Exception No._______

you are claiming here and on Form 40, box 51a; or Form 40N or Form 40P, box 69a ..................................... 1

pARt A—Figure your required annual payment

.00

2. 2007 net income tax from Form 40, line 41; or Form 40N or Form 40P, line 58 ............................................... 2

3. 2007 refundable tax credit amounts you claimed on Form 40, lines 44–46; or

.00

Form 40N or Form 40P, lines 62–64 .........................................................................................................................3

.00

4. Line 2 minus line 3 ............................................................................................................................................. 4

.00

5. Multiply line 4 by 90% (0.90) ............................................................................................5

.00

6. 2007 Oregon income tax withheld from income ................................................................................................ 6

.00

7. Line 4 minus line 6. If less than $1,000, stop here! You do not owe underpayment interest .......................... 7

.00

8. Enter your 2006 tax after nonrefundable and refundable credits (see instructions) .......................................... 8

.00

9. Required annual payment. Enter the smaller of line 5 or line 8 ....................................................................... 9

Note: If line 6 is equal to or more than line 9, stop here! You do not owe underpayment interest. Attach this form to your return.

A

B

c

D

pARt B—Figure your required periodic payment

10. Payment period due date ............................................................ 10

April 17, 2007

June 15, 2007

Sept. 17, 2007

Jan. 15, 2008

11. Divide the amount on line 9 by four and enter the amount

in each column, or if you use the Annualized Income

Worksheet on the back of this form, enter the amounts

from line 31 here (see instructions) ............................................. 11

pARt c — Figure your interest (

See page 3 of the instructions)

No. of

Monthly

No. of

Daily

Interest

Date

Event

Amount

Running Balance

Months

Rate

Days

Rate

Due

4/17/07

Req. Pymt.

.

.

12.

.

.

.

13. 4/17/07

Withholding

0.007500

0.000247

14.

Payment

.

.

0.007500

0.000247

.

.

.

.

15.

Payment

0.007500

0.000247

16.

Payment

.

.

0.007500

0.000247

.

17. 6/15/07

Req. Pymt.

.

.

.

.

.

18. 6/15/07

Withholding

0.007500

0.000247

19.

Payment

.

.

0.007500

0.000247

.

20.

Payment

.

.

0.007500

0.000247

.

.

.

.

21.

Payment

0.007500

0.000247

22. 9/17/07

Req. Pymt.

.

.

.

.

.

23. 9/17/07

Withholding

0.007500

0.000247

24.

Payment

.

.

0.007500

0.000247

.

25.

Payment

.

.

0.007500

0.000247

.

.

.

.

26.

Payment

0.007500

0.000247

27. 1/15/08

Rate Chg.

.

28. 1/15/08

Req. Pymt.

.

.

.

.

.

29. 1/15/08

Withholding

0.007500

0.000247

30.

Payment

.

.

0.007500

0.000247

.

.

.

.

31.

Payment

0.007500

0.000247

32.

Payment

.

.

0.007500

0.000247

.

33. 4/15/08

— Do not calculate interest after April 15, 2008 —

34. total interest due. Add the amounts in the interest column. Round to the nearest

.00

whole dollar and enter here and on Form 40, line 51; or Form 40N or Form 40P, line 69 .............................. 34

150-101-028 (12-07)

1

1 2

2