Clear This Page

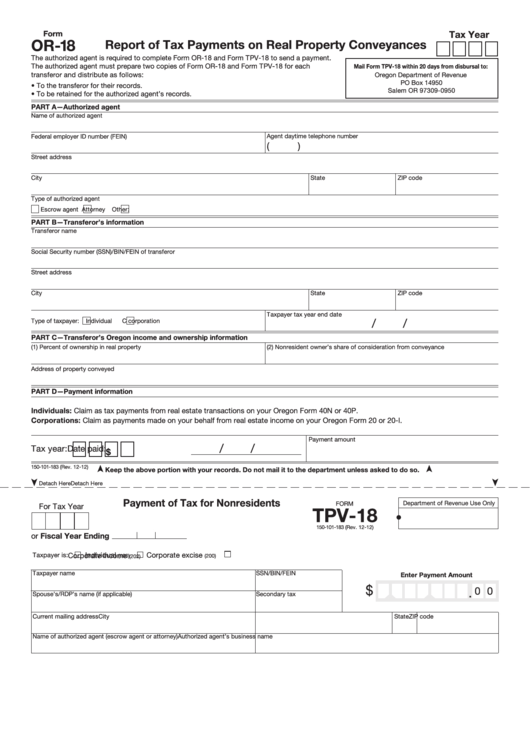

Tax Year

Form

OR-18

Report of Tax Payments on Real Property Conveyances

The authorized agent is required to complete Form OR-18 and Form TPV-18 to send a payment.

The authorized agent must prepare two copies of Form OR-18 and Form TPV-18 for each

Mail Form TPV-18 within 20 days from disbursal to:

transferor and distribute as follows:

Oregon Department of Revenue

PO Box 14950

• To the transferor for their records.

Salem OR 97309-0950

• To be retained for the authorized agent’s records.

PART A—Authorized agent

Name of authorized agent

Agent daytime telephone number

Federal employer ID number (FEIN)

(

)

Street address

City

State

ZIP code

Type of authorized agent

Escrow agent

Attorney

Other:

PART B—Transferor’s information

Transferor name

Social Security number (SSN)/BIN/FEIN of transferor

Street address

City

State

ZIP code

Taxpayer tax year end date

/

/

Type of taxpayer:

Individual

C corporation

PART C—Transferor’s Oregon income and ownership information

(1) Percent of ownership in real property

(2) Nonresident owner’s share of consideration from conveyance

Address of property conveyed

PART D—Payment information

Individuals: Claim as tax payments from real estate transactions on your Oregon Form 40N or 40P.

Corporations: Claim as payments made on your behalf from real estate income on your Oregon Form 20 or 20-I.

Payment amount

/

/

Tax year:

Date paid:

$

150-101-183 (Rev. 12-12)

Keep the above portion with your records. Do not mail it to the department unless asked to do so.

Detach Here

Detach Here

Payment of Tax for Nonresidents

Department of Revenue Use Only

FORM

For Tax Year

TPV-18

•

150-101-183 (Rev. 12-12)

or Fiscal Year Ending

Taxpayer is:

Individual

Corporate excise

Corporate income

(100)

(200)

(202)

Taxpayer name

SSN/BIN/FEIN

Enter Payment Amount

$

0 0

.

Spouse’s/RDP’s name (if applicable)

Secondary tax I.D. number

Current mailing address

City

State

ZIP code

Name of authorized agent (escrow agent or attorney)

Authorized agent’s business name

1

1 2

2