Print Form

Reset Form

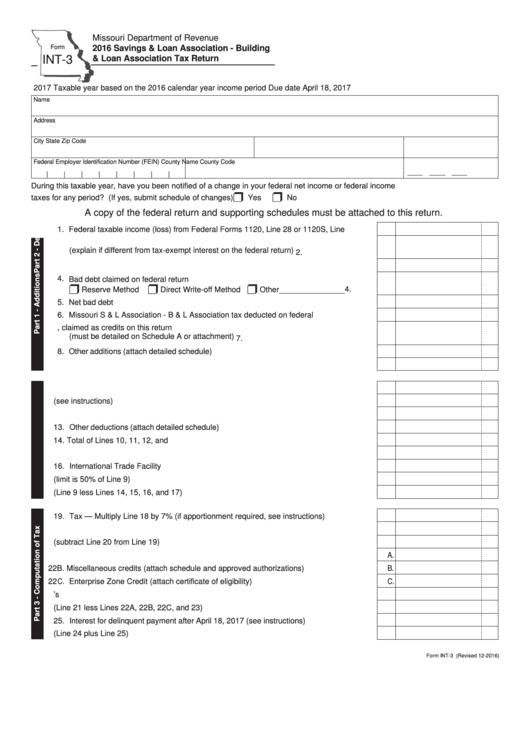

Missouri Department of Revenue

Form

2016 Savings & Loan Association - Building

INT-3

& Loan Association Tax Return

2017 Taxable year based on the 2016 calendar year income period

Due date April 18, 2017

Name

Address

City

State

Zip Code

Federal Employer Identification Number (FEIN)

County Name

County Code

|

|

|

|

|

|

|

|

During this taxable year, have you been notified of a change in your federal net income or federal income

r

r

taxes for any period? (If yes, submit schedule of changes) .........................................................................................

Yes

No

A copy of the federal return and supporting schedules must be attached to this return.

1. Federal taxable income (loss) from Federal Forms 1120, Line 28 or 1120S, Line 21.........

1

2. Income from state and political subdivision obligations not included in federal income

(explain if different from tax-exempt interest on the federal return).....................................

2.

3. Income from federal government securities not included in federal income

3.

4. Bad debt claimed on federal return

r

r

r

Other_______________ ..............

4.

Reserve Method

Direct Write-off Method

5. Net bad debt recoveries.......................................................................................................

5.

6. Missouri S & L Association - B & L Association tax deducted on federal return..................

6.

7. Taxes deducted on federal return, claimed as credits on this return

(must be detailed on Schedule A or attachment).................................................................

7.

8. Other additions (attach detailed schedule)...........................................................................

8.

9. Total of Lines 1 through 8....................................................................................................

9.

10. Net bad debt charge offs.....................................................................................................

10.

11. Federal income tax deduction (see instructions)................................................................. 11.

12. Charitable contribution in excess of allowable federal deduction........................................ 12.

13. Other deductions (attach detailed schedule)........................................................................ 13.

14. Total of Lines 10, 11, 12, and 13......................................................................................... 14.

15. Port Cargo Expansion deduction......................................................................................... 15.

16. International Trade Facility deduction.................................................................................. 16.

17. Qualified Trade Activities deduction (limit is 50% of Line 9)..............................................

17.

18. Taxable income (Line 9 less Lines 14, 15, 16, and 17)....................................................... 18.

19. Tax — Multiply Line 18 by 7% (if apportionment required, see instructions)....................... 19.

20. Credits from Line 7 above...................................................................................................

20.

21. Tax after allowable credits (subtract Line 20 from Line 19)................................................. 21.

22A. Less tentative payment or amount previously paid............................................................. 22A.

22B. Miscellaneous credits (attach schedule and approved authorizations)............................... 22B.

22C. Enterprise Zone Credit (attach certificate of eligibility)........................................................ 22C.

23. Less overpayment of previous year’s tax............................................................................

23.

24. Balance due or overpaid (Line 21 less Lines 22A, 22B, 22C, and 23)................................ 24.

25. Interest for delinquent payment after April 18, 2017 (see instructions)................................ 25.

26. Total amount due or overpayment to be refunded (Line 24 plus Line 25)........................... 26.

Form INT-3 (Revised 12-2016)

1

1 2

2