Employer'S Withholding Reconciliation - City Of Canfield Income Tax

ADVERTISEMENT

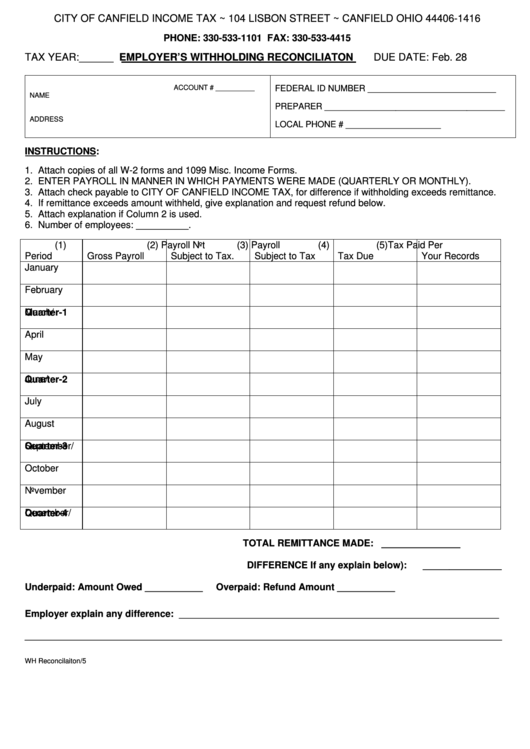

CITY OF CANFIELD INCOME TAX ~ 104 LISBON STREET ~ CANFIELD OHIO 44406-1416

PHONE: 330-533-1101

FAX: 330-533-4415

TAX YEAR:______ EMPLOYER’S WITHHOLDING RECONCILIATON

DUE DATE: Feb. 28

ACCOUNT # __________

FEDERAL ID NUMBER ___________________________

NAME

PREPARER ______________________________________

ADDRESS

LOCAL PHONE # ____________________

INSTRUCTIONS:

1. Attach copies of all W-2 forms and 1099 Misc. Income Forms.

2. ENTER PAYROLL IN MANNER IN WHICH PAYMENTS WERE MADE (QUARTERLY OR MONTHLY).

3. Attach check payable to CITY OF CANFIELD INCOME TAX, for difference if withholding exceeds remittance.

4. If remittance exceeds amount withheld, give explanation and request refund below.

5. Attach explanation if Column 2 is used.

6. Number of employees: __________.

(1)

(2) Payroll Not

(3) Payroll

(4)

(5)Tax Paid Per

Period

Gross Payroll

Subject to Tax.

Subject to Tax

Tax Due

Your Records

January

February

March/

Quarter-1

April

May

June/

Quarter-2

July

August

September/

Quarter-3

October

November

December/

Quarter-4

TOTAL REMITTANCE MADE:

_______________

DIFFERENCE If any explain below):

_______________

Underpaid: Amount Owed ___________

Overpaid: Refund Amount ___________

Employer explain any difference: _____________________________________________________________

___________________________________________________________________________________________

WH Reconcilaiton/5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1