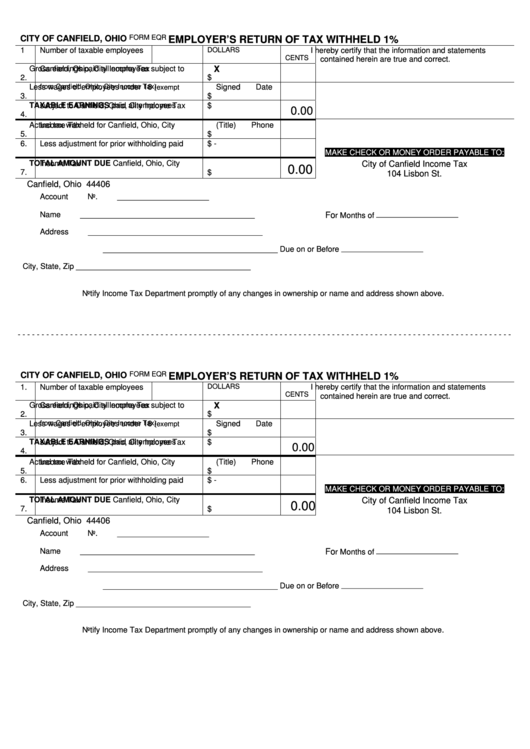

CITY OF CANFIELD, OHIO

FORM EQR

EMPLOYER’S RETURN OF TAX WITHHELD

1%

I hereby certify that the information and statements

DOLLARS

CENTS

1

Number of taxable employees

contained herein are true and correct.

Gross earnings paid all employees subject to

X

2.

Canfield, Ohio, City Income Tax

$

Less wages of employees under 18

Signed

Date

(exempt

3.

from Canfield, Ohio, City Income Tax)

$

TAXABLE EARNINGS paid all employees

0.00

4.

subject to Canfield, Ohio, City Income Tax

$

Actual tax withheld for Canfield, Ohio, City

(Title)

Phone

5.

Income Tax

$

6.

Less adjustment for prior withholding paid

$ -

MAKE CHECK OR MONEY ORDER PAYABLE TO:

TOTAL AMOUNT DUE Canfield, Ohio, City

City of Canfield Income Tax

0.00

7.

Income Tax

$

104 Lisbon St.

Canfield, Ohio 44406

Account No.

_____________________

Name

________________________________________

_____________________

Fo

r Months of

Address

________________________________________

________________________________________

Due on or Before

_____________________

City, State, Zip

________________________________________

.

Notify Income Tax Department promptly of any changes in ownership or name and address shown above

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

FORM EQR

CITY OF CANFIELD, OHIO

EMPLOYER’S RETURN OF TAX WITHHELD

1%

I hereby certify that the information and statements

DOLLARS

CENTS

1.

Number of taxable employees

contained herein are true and correct.

Gross earnings paid all employees subject to

X

2.

Canfield, Ohio, City Income Tax

$

Less wages of employees under 18

Signed

Date

(exempt

3.

from Canfield, Ohio, City Income Tax)

$

TAXABLE EARNINGS paid all employees

0.00

4.

subject to Canfield, Ohio, City Income Tax

$

Actual tax withheld for Canfield, Ohio, City

(Title)

Phone

5.

Income Tax

$

6.

Less adjustment for prior withholding paid

$ -

MAKE CHECK OR MONEY ORDER PAYABLE TO:

TOTAL AMOUNT DUE Canfield, Ohio, City

City of Canfield Income Tax

0.00

7.

Income Tax

$

104 Lisbon St.

Canfield, Ohio 44406

Account No.

_____________________

Name

________________________________________

Fo

_____________________

r Months of

Address

________________________________________

_____________________

________________________________________

Due on or Before

City, State, Zip

________________________________________

.

Notify Income Tax Department promptly of any changes in ownership or name and address shown above

1

1