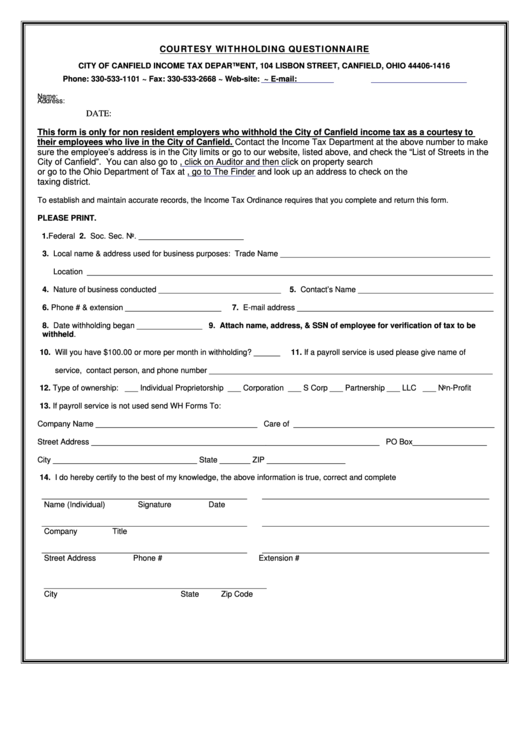

COURTESY WITHHOLDING QUESTIONNAIRE

CITY OF CANFIELD INCOME TAX DEPARTMENT, 104 LISBON STREET, CANFIELD, OHIO 44406-1416

Phone: 330-533-1101 ~ Fax: 330-533-2668 ~ Web-site:

~ E-mail:

vshook@ci.canfield.oh.us

Name:

Address:

DATE:

This form is only for non resident employers who withhold the City of Canfield income tax as a courtesy to

their employees who live in the City of Canfield. Contact the Income Tax Department at the above number to make

sure the employee’s address is in the City limits or go to our website, listed above, and check the “List of Streets in the

City of Canfield”. You can also go to , click on Auditor and then click on property search

or go to the Ohio Department of Tax at , go to The Finder and look up an address to check on the

taxing district.

To establish and maintain accurate records, the Income Tax Ordinance requires that you complete and return this form.

PLEASE PRINT.

1. Federal I.D. No. _________________________________

2. Soc. Sec. No. ________________________

3. Local name & address used for business purposes: Trade Name ________________________________________________

Location _____________________________________________________________________________________________

4. Nature of business conducted ____________________________

5. Contact’s Name _______________________________

6. Phone # & extension ______________________

7. E-mail address _____________________________________________

8. Date withholding began _______________ 9. Attach name, address, & SSN of employee for verification of tax to be

withheld.

10. Will you have $100.00 or more per month in withholding? ______

11. If a payroll service is used please give name of

service, contact person, and phone number _________________________________________________________________

12. Type of ownership: ___ Individual Proprietorship ___ Corporation ___ S Corp ___ Partnership ___ LLC ___ Non-Profit

13. If payroll service is not used send WH Forms To:

Company Name _____________________________________ Care of ______________________________________________

Street Address __________________________________________________________________ PO Box_________________

City _________________________________ State _______ ZIP __________________

14. I do hereby certify to the best of my knowledge, the above information is true, correct and complete

_______________________________________________

____________________________________________________

Name (Individual)

Signature

Date

_______________________________________________

____________________________________________________

Company

Title

_______________________________________________

____________________________________________________

Street Address

Phone #

Extension #

___________________________________________________

City

State

Zip Code

1

1