Business License Tax Return - Liquor Tax Form - Rds

ADVERTISEMENT

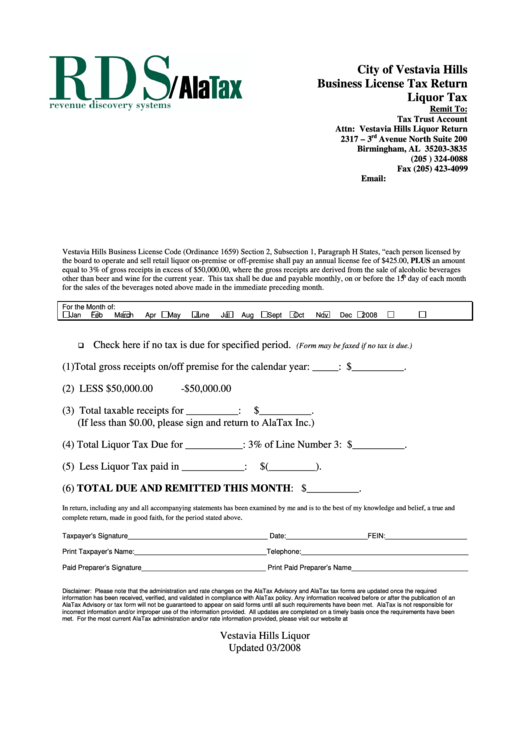

City of Vestavia Hills

Business License Tax Return

Liquor Tax

Remit To:

Tax Trust Account

Attn: Vestavia Hills Liquor Return

rd

2317 – 3

Avenue North Suite 200

Birmingham, AL 35203-3835

(205 ) 324-0088

Fax (205) 423-4099

Email:

Vestavia Hills Business License Code (Ordinance 1659) Section 2, Subsection 1, Paragraph H States, “each person licensed by

the board to operate and sell retail liquor on-premise or off-premise shall pay an annual license fee of $425.00, PLUS an amount

equal to 3% of gross receipts in excess of $50,000.00, where the gross receipts are derived from the sale of alcoholic beverages

th

other than beer and wine for the current year. This tax shall be due and payable monthly, on or before the 15

day of each month

for the sales of the beverages noted above made in the immediate preceding month.

For the Month of:

Jan

Feb

March

Apr

May

June

Jul

Aug

Sept

Oct

Nov

Dec

2008

Check here if no tax is due for specified period.

(Form may be faxed if no tax is due.)

(1) Total gross receipts on/off premise for the calendar year: _____:

$__________.

(2) LESS $50,000.00

-$50,000.00

(3) Total taxable receipts for __________:

$__________.

(If less than $0.00, please sign and return to AlaTax Inc.)

(4) Total Liquor Tax Due for ___________: 3% of Line Number 3:

$__________.

(5) Less Liquor Tax paid in ____________:

$(_________).

(6) TOTAL DUE AND REMITTED THIS MONTH:

$__________.

In return, including any and all accompanying statements has been examined by me and is to the best of my knowledge and belief, a true and

.

complete return, made in good faith, for the period stated above

Taxpayer’s Signature____________________________________ Date:_____________________FEIN:_____________________

Print Taxpayer’s Name:__________________________________Telephone:___________________________________________

Paid Preparer’s Signature________________________________ Print Paid Preparer’s Name______________________________

Disclaimer: Please note that the administration and rate changes on the AlaTax Advisory and AlaTax tax forms are updated once the required

information has been received, verified, and validated in compliance with AlaTax policy. Any information received before or after the publication of an

AlaTax Advisory or tax form will not be guaranteed to appear on said forms until all such requirements have been met. AlaTax is not responsible for

incorrect information and/or improper use of the information provided. All updates are completed on a timely basis once the requirements have been

met. For the most current AlaTax administration and/or rate information provided, please visit our website at

Vestavia Hills Liquor

Updated 03/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1