Form Cct - Consumer Counsel Tax April 2006

ADVERTISEMENT

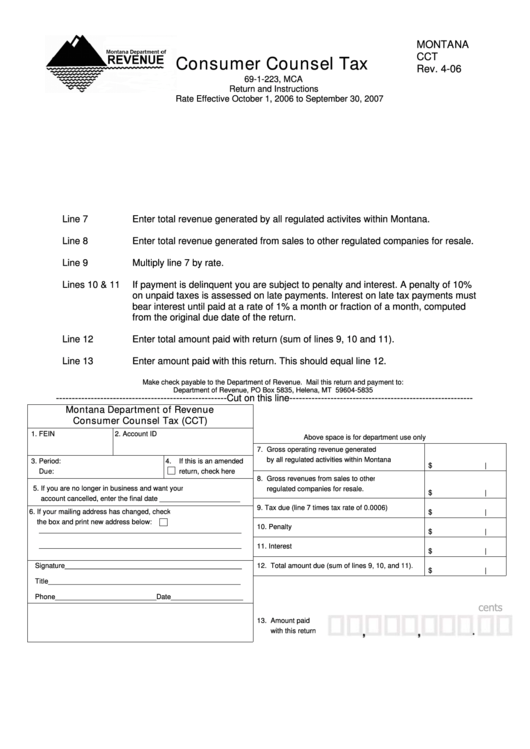

MONTANA

CCT

Consumer Counsel Tax

Rev. 4-06

69-1-223, MCA

Return and Instructions

Rate Effective October 1, 2006 to September 30, 2007

Line 7

Enter total revenue generated by all regulated activites within Montana.

Line 8

Enter total revenue generated from sales to other regulated companies for resale.

Line 9

Multiply line 7 by rate.

Lines 10 & 11

If payment is delinquent you are subject to penalty and interest. A penalty of 10%

on unpaid taxes is assessed on late payments. Interest on late tax payments must

bear interest until paid at a rate of 1% a month or fraction of a month, computed

from the original due date of the return.

Line 12

Enter total amount paid with return (sum of lines 9, 10 and 11).

Line 13

Enter amount paid with this return. This should equal line 12.

Make check payable to the Department of Revenue. Mail this return and payment to:

Department of Revenue, PO Box 5835, Helena, MT 59604-5835

------------------------------------------------------Cut on this line----------------------------------------------------------

Montana Department of Revenue

Consumer Counsel Tax (CCT)

1. FEIN

2. Account ID

Above space is for department use only

7. Gross operating revenue generated

by all regulated activities within Montana

3. Period:

4.

If this is an amended

$

|

Due:

return, check here

8. Gross revenues from sales to other

5. If you are no longer in business and want your

regulated companies for resale.

$

|

account cancelled, enter the final date _____________________

9. Tax due (line 7 times tax rate of 0.0006)

6. If your mailing address has changed, check

$

|

the box and print new address below:

10. Penalty

$

|

11. Interest

$

|

Signature______________________________________________

12. Total amount due (sum of lines 9, 10, and 11).

$

|

Title__________________________________________________

Phone__________________________Date___________________

cents

13. Amount paid

with this return

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1