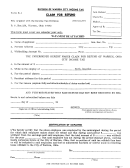

Form Bl-1 - Application For Business License For The City Of Waynesboro Page 2

ADVERTISEMENT

TO:

APPLICANT FOR CITY OF WAYNESBORO BUSINESS LICENSE

FROM: OFFICE OF COMMISSIONER OF THE REVENUE

To apply for your license, the following steps (applicable to your situation), must be completed

before a business license can be issued by the Commissioner of the Revenue.

NOTE: LICENSES MUST BE OBTAINED WITHIN 30 DAYS OF THE START OF BUSINESS. A 10%

late payment penalty and interest will be imposed if the license is not obtained within 30 days of starting

your business.

STEP 1

*Contact the Waynesboro Building & Zoning Dept., 250 S. Wayne Ave, Room 206

(942-6628) to verify the location is properly zoned before you begin operations.

*If your business is operated from a residence, you will need to obtain prior

approval from the Waynesboro Building & Zoning Dept., 250 S. Wayne Ave., Room

206 (942-6628) and apply for a $50.00 Home Occupation Permit.

STEP 2

*All contractors must register with the State Board of Contractors (804-367-8511)

if you are a contractor and will be accepting individual contracts of $1000 or more.

We require your state license number for your business license. If your individual

contracts are less than $1000 and you do not have to obtain a state license, you

will be required to sign a written statement.

STEP 3

*Before a food establishment license can be issued by the Commissioner’s Office,

the business must be approved by the Waynesboro Health Dept. (949-0137) and

a copy of their approval supplied to our office. In addition, if alcoholic beverages

are being sold, approval from the ABC Board must be obtained and an additional

business license is required.

STEP 4

*Contact the Clerk of the Circuit Court, 250 S. Wayne Ave., (942-6616)

if you will be operating your business under a fictitious trade name. Trade names

must be registered with the Clerk’s office and proof of registration (a copy of the

receipt) must be supplied to the Commissioner’s office.

STEP 5

*If your business is incorporated, the documents showing registration with the

State Corporation Commission with corporate name and trade name must be

supplied to the Commissioner’s office.

Upon completion of the requirements listed above, a license will be processed by the

Commissioner of the Revenue based on the following business license tax rates:

CATEGORY

RATE

MINIMUM LICENSE

#1 Contractor

.16/$100 gross receipts

$30.00 for a gross up to $18,750

#2 Retail

.20/$100 gross receipts

$30.00 for a gross up to $15,000

#3 Professional

.58/$100 gross receipts

$30.00 for a gross up to $ 5,172

#4 Service/Repair .36/$100 gross receipts

$30.00 for a gross up to $ 8,333

#5 Wholesale

$50 plus .15/$100 gross purchases

Note: For categories #1 thru #4, any business with less than $4000 gross, will be issued a

Certificate of Exemption and the minimum license fee will be waived.

….Gross (receipts; purchases) are estimated initially and reconciled the following year based on

actual gross. ….All business licenses are based on a calendar year (January to December).

st

Business licenses must be renewed by March 1

.

In addition to obtaining a business license, Waynesboro levies a tax on tangible personal property

used in a trade or business (furniture, fixtures, equipment, etc.) located in Waynesboro on

st

st

January 1

. You must file a return with the Commissioner of the Revenue by May 1

. The

th

payment date for business personal property is December 5

.

Form BL-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2