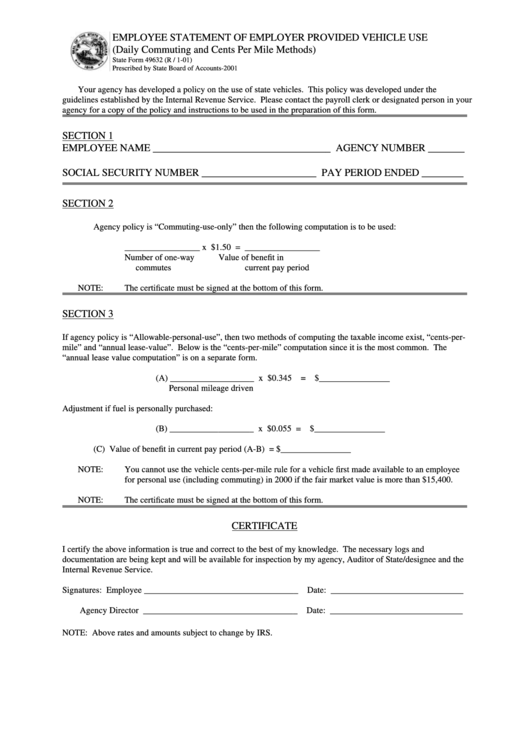

EMPLOYEE STATEMENT OF EMPLOYER PROVIDED VEHICLE USE

(Daily Commuting and Cents Per Mile Methods)

State Form 49632 (R / 1-01)

Prescribed by State Board of Accounts-2001

Your agency has developed a policy on the use of state vehicles. This policy was developed under the

guidelines established by the Internal Revenue Service. Please contact the payroll clerk or designated person in your

agency for a copy of the policy and instructions to be used in the preparation of this form.

SECTION 1

EMPLOYEE NAME __________________________________ AGENCY NUMBER _______

SOCIAL SECURITY NUMBER ______________________ PAY PERIOD ENDED ________

SECTION 2

Agency policy is “Commuting-use-only” then the following computation is to be used:

_________________ x $1.50 = _________________

Number of one-way

Value of benefit in

commutes

current pay period

NOTE:

The certificate must be signed at the bottom of this form.

SECTION 3

If agency policy is “Allowable-personal-use”, then two methods of computing the taxable income exist, “cents-per-

mile” and “annual lease-value”. Below is the “cents-per-mile” computation since it is the most common. The

“annual lease value computation” is on a separate form.

(A) ___________________ x $0.345 = $________________

Personal mileage driven

Adjustment if fuel is personally purchased:

(B) ___________________ x $0.055 = $________________

(C) Value of benefit in current pay period (A-B) = $________________

NOTE:

You cannot use the vehicle cents-per-mile rule for a vehicle first made available to an employee

for personal use (including commuting) in 2000 if the fair market value is more than $15,400.

NOTE:

The certificate must be signed at the bottom of this form.

CERTIFICATE

I certify the above information is true and correct to the best of my knowledge. The necessary logs and

documentation are being kept and will be available for inspection by my agency, Auditor of State/designee and the

Internal Revenue Service.

Signatures: Employee ___________________________________ Date: ______________________________

Agency Director ___________________________________ Date: ______________________________

NOTE: Above rates and amounts subject to change by IRS.

1

1