Form 1120es-Me - Estimated Tax Worksheet

ADVERTISEMENT

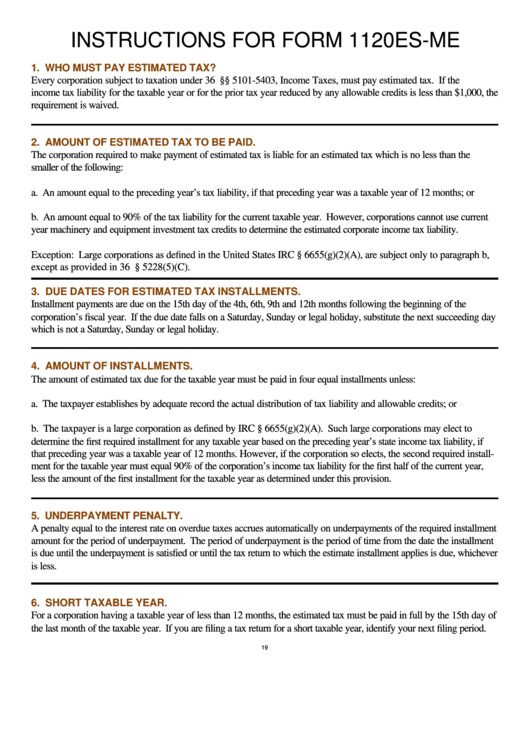

INSTRUCTIONS FOR FORM 1120ES-ME

1. WHO MUST PAY ESTIMATED TAX?

Every corporation subject to taxation under 36 M.R.S.A. §§ 5101-5403, Income Taxes, must pay estimated tax. If the

income tax liability for the taxable year or for the prior tax year reduced by any allowable credits is less than $1,000, the

requirement is waived.

2. AMOUNT OF ESTIMATED TAX TO BE PAID.

The corporation required to make payment of estimated tax is liable for an estimated tax which is no less than the

smaller of the following:

a. An amount equal to the preceding year’s tax liability, if that preceding year was a taxable year of 12 months; or

b. An amount equal to 90% of the tax liability for the current taxable year. However, corporations cannot use current

year machinery and equipment investment tax credits to determine the estimated corporate income tax liability.

Exception: Large corporations as defined in the United States IRC § 6655(g)(2)(A), are subject only to paragraph b,

except as provided in 36 M.R.S.A. § 5228(5)(C).

3. DUE DATES FOR ESTIMATED TAX INSTALLMENTS.

Installment payments are due on the 15th day of the 4th, 6th, 9th and 12th months following the beginning of the

corporation’s fiscal year. If the due date falls on a Saturday, Sunday or legal holiday, substitute the next succeeding day

which is not a Saturday, Sunday or legal holiday.

4. AMOUNT OF INSTALLMENTS.

The amount of estimated tax due for the taxable year must be paid in four equal installments unless:

a. The taxpayer establishes by adequate record the actual distribution of tax liability and allowable credits; or

b. The taxpayer is a large corporation as defined by IRC § 6655(g)(2)(A). Such large corporations may elect to

determine the first required installment for any taxable year based on the preceding year’s state income tax liability, if

that preceding year was a taxable year of 12 months. However, if the corporation so elects, the second required install-

ment for the taxable year must equal 90% of the corporation’s income tax liability for the first half of the current year,

less the amount of the first installment for the taxable year as determined under this provision.

5. UNDERPAYMENT PENALTY.

A penalty equal to the interest rate on overdue taxes accrues automatically on underpayments of the required installment

amount for the period of underpayment. The period of underpayment is the period of time from the date the installment

is due until the underpayment is satisfied or until the tax return to which the estimate installment applies is due, whichever

is less.

6. SHORT TAXABLE YEAR.

For a corporation having a taxable year of less than 12 months, the estimated tax must be paid in full by the 15th day of

the last month of the taxable year. If you are filing a tax return for a short taxable year, identify your next filing period.

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2