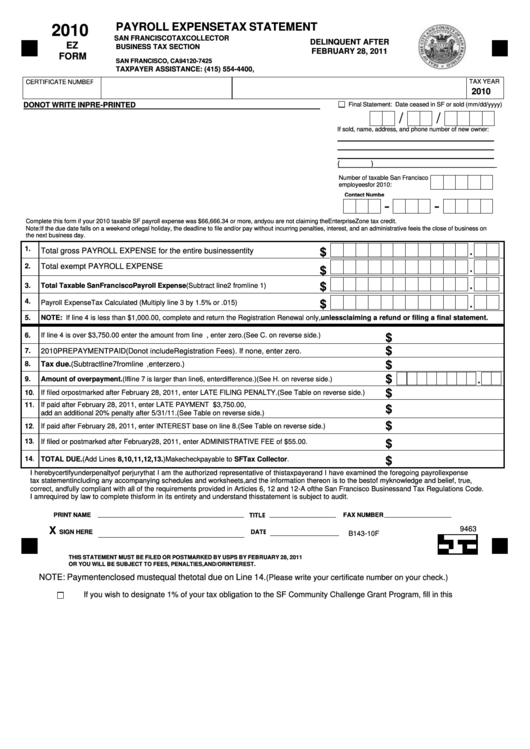

PAYROLL EXPENSE TAX STATEMENT

2010

SAN FRANCISCO TAX COLLECTOR

DELINQUENT AFTER

EZ

BUSINESS TAX SECTION

FEBRUARY 28, 2011

P.O. BOX 7425

FORM

SAN FRANCISCO, CA 94120-7425

TAXPAYER ASSISTANCE: (415) 554-4400,

TAX YEAR

CERTIFICATE NUMBER

2010

DO NOT WRITE IN PRE-PRINTED AREAS. USE BLACK INK AND STAY INSIDE BOXES.

Final Statement: Date ceased in SF or sold (mm/dd/yyyy)

/

/

If sold, name, address, and phone number of new owner:

____________________________________

____________________________________

____________________________________

(_______)____________________________

Number of taxable San Francisco

employees for 2010:

Contact Number

-

-

Complete this form if your 2010 taxable SF payroll expense was $66,666.34 or more, and you are not claiming the Enterprise Zone tax credit.

Note: If the due date falls on a weekend or legal holiday, the deadline to file and/or pay without incurring penalties, interest, and an administrative fee is the close of business on

the next business day.

.

1.

$

Total gross PAYROLL EXPENSE for the entire business entity

.

2.

Total exempt PAYROLL EXPENSE

$

.

$

3.

Total Taxable San Francisco Payroll Expense (Subtract line 2 from line 1)

.

4.

$

Payroll ExpenseTax Calculated (Multiply line 3 by 1.5% or .015)

5.

NOTE: If line 4 is less than $1,000.00, complete and return the Registration Renewal only, unless claiming a refund or filing a final statement.

If line 4 is over $3,750.00 enter the amount from line 4. Otherwise, enter zero. (See C. on reverse side.)

6.

$

$

7.

2010 PREPAYMENT PAID (Do not include Registration Fees). If none, enter zero.

$

Tax due. (Subtract line 7 from line 6. If line 7 is larger than line 6, enter zero.)

8.

.

$

9.

Amount of overpayment. (If line 7 is larger than line 6, enter difference.) (See H. on reverse side.)

$

If filed or postmarked after February 28, 2011, enter LATE FILING PENALTY. (See Table on reverse side.)

10.

11.

If paid after February 28, 2011, enter LATE PAYMENT PENALTY. If Line 4 is greater than $3,750.00,

$

add an additional 20% penalty after 5/31/11. (See Table on reverse side.)

$

If paid after February 28, 2011, enter INTEREST base on line 8. (See Table on reverse side.)

12.

13.

If filed or postmarked after February 28, 2011, enter ADMINISTRATIVE FEE of $55.00.

$

$

14.

TOTAL DUE. (Add Lines 8,10,11,12,13.) Make check payable to SF Tax Collector.

I hereby certify under penalty of perjury that I am the authorized representative of this taxpayer and I have examined the foregoing payroll expense

tax statement including any accompanying schedules and worksheets, and the information thereon is to the best of my knowledge and belief, true,

correct, and fully compliant with all of the requirements provided in Articles 6, 12 and 12-A of the San Francisco Business and Tax Regulations Code.

I am required by law to complete this form in its entirety and understand this statement is subject to audit.

PRINT NAME

TITLE

FAX NUMBER

9463

X

SIGN HERE

DATE

B143-10F

THIS STATEMENT MUST BE FILED OR POSTMARKED BY USPS BY FEBRUARY 28, 2011

OR YOU WILL BE SUBJECT TO FEES, PENALTIES, AND/OR INTEREST.

NOTE: Payment enclosed must equal the total due on Line 14.

(Please write your certificate number on your check.)

If you wish to designate 1% of your tax obligation to the SF Community Challenge Grant Program, fill in this

box. This will not increase your tax.

1

1