Filing Schedule - Sales And Use Tax Notices

ADVERTISEMENT

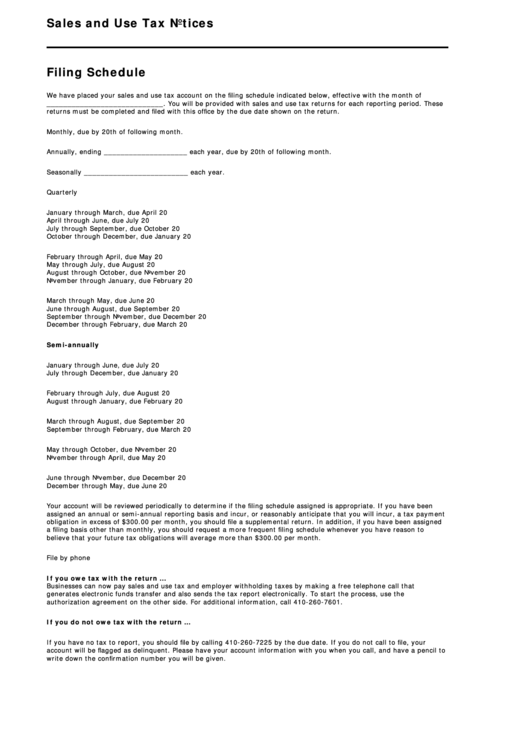

Sales and Use Tax Notices

Filing Schedule

We have placed your sales and use tax account on the filing schedule indicated below, effective with the month of

____________________________. You will be provided with sales and use tax returns for each reporting period. These

returns must be completed and filed with this office by the due date shown on the return.

Monthly, due by 20th of following month.

Annually, ending ____________________ each year, due by 20th of following month.

Seasonally _________________________ each year.

Quarterly

January through March, due April 20

April through June, due July 20

July through September, due October 20

October through December, due January 20

February through April, due May 20

May through July, due August 20

August through October, due November 20

November through January, due February 20

March through May, due June 20

June through August, due September 20

September through November, due December 20

December through February, due March 20

Semi-annually

January through June, due July 20

July through December, due January 20

February through July, due August 20

August through January, due February 20

March through August, due September 20

September through February, due March 20

May through October, due November 20

November through April, due May 20

June through November, due December 20

December through May, due June 20

Your account will be reviewed periodically to determine if the filing schedule assigned is appropriate. If you have been

assigned an annual or semi-annual reporting basis and incur, or reasonably anticipate that you will incur, a tax payment

obligation in excess of $300.00 per month, you should file a supplemental return. In addition, if you have been assigned

a filing basis other than monthly, you should request a more frequent filing schedule whenever you have reason to

believe that your future tax obligations will average more than $300.00 per month.

File by phone

If you owe tax with the return ...

Businesses can now pay sales and use tax and employer withholding taxes by making a free telephone call that

generates electronic funds transfer and also sends the tax report electronically. To start the process, use the

authorization agreement on the other side. For additional information, call 410-260-7601.

If you do not owe tax with the return ...

If you have no tax to report, you should file by calling 410-260-7225 by the due date. If you do not call to file, your

account will be flagged as delinquent. Please have your account information with you when you call, and have a pencil to

write down the confirmation number you will be given.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2