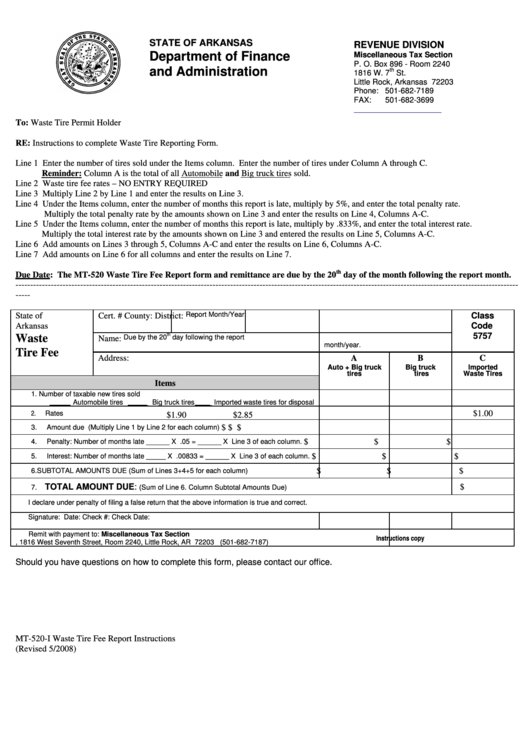

Form Mt-520-I - Waste Tire Fee Report

ADVERTISEMENT

STATE OF ARKANSAS

REVENUE DIVISION

Department of Finance

Miscellaneous Tax Section

P. O. Box 896 - Room 2240

and Administration

th

1816 W. 7

St.

Little Rock, Arkansas 72203

Phone: 501-682-7189

FAX:

501-682-3699

To: Waste Tire Permit Holder

RE: Instructions to complete Waste Tire Reporting Form.

Line 1 Enter the number of tires sold under the Items column. Enter the number of tires under Column A through C.

Reminder: Column A is the total of all Automobile and Big truck tires sold.

Line 2 Waste tire fee rates – NO ENTRY REQUIRED

Line 3 Multiply Line 2 by Line 1 and enter the results on Line 3.

Line 4 Under the Items column, enter the number of months this report is late, multiply by 5%, and enter the total penalty rate.

Multiply the total penalty rate by the amounts shown on Line 3 and enter the results on Line 4, Columns A-C.

Line 5 Under the Items column, enter the number of months this report is late, multiply by .833%, and enter the total interest rate.

Multiply the total interest rate by the amounts shown on Line 3 and entered the results on Line 5, Columns A-C.

Line 6 Add amounts on Lines 3 through 5, Columns A-C and enter the results on Line 6, Columns A-C.

Line 7 Add amounts on Line 6 for all columns and enter the results on Line 7.

th

Due Date: The MT-520 Waste Tire Fee Report form and remittance are due by the 20

day of the month following the report month.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------

-----

Report Month/Year:

State of

Cert. #

County:

District:

Class

Arkansas

Code

th

5757

Waste

Due by the 20

day following the report

Name:

month/year.

Tire Fee

Address:

A

B

C

Auto + Big truck

Big truck

Imported

tires

tires

Waste Tires

Items

1.

Number of taxable new tires sold

_____ Automobile tires _____ Big truck tires ____ Imported waste tires for disposal

2.

$1.00

Rates

$1.90

$2.85

$

$

$

3.

Amount due (Multiply Line 1 by Line 2 for each column)

4.

Penalty: Number of months late ______ X .05 = ______ X Line 3 of each column.

$

$

$

$

$

$

5.

Interest: Number of months late _____ X .00833 = ______ X Line 3 of each column.

$

$

$

6.

SUBTOTAL AMOUNTS DUE (Sum of Lines 3+4+5 for each column)

TOTAL AMOUNT DUE:

$

7.

(Sum of Line 6. Column Subtotal Amounts Due)

I declare under penalty of filing a false return that the above information is true and correct.

Signature:

Date:

Check #:

Check Date:

Remit with payment to: Miscellaneous Tax Section

Instructions copy

P.O. Box 896, 1816 West Seventh Street, Room 2240, Little Rock, AR 72203 (501-682-7187)

Should you have questions on how to complete this form, please contact our office.

MT-520-I Waste Tire Fee Report Instructions

(Revised 5/2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1