Print...

Clear

West Virginia

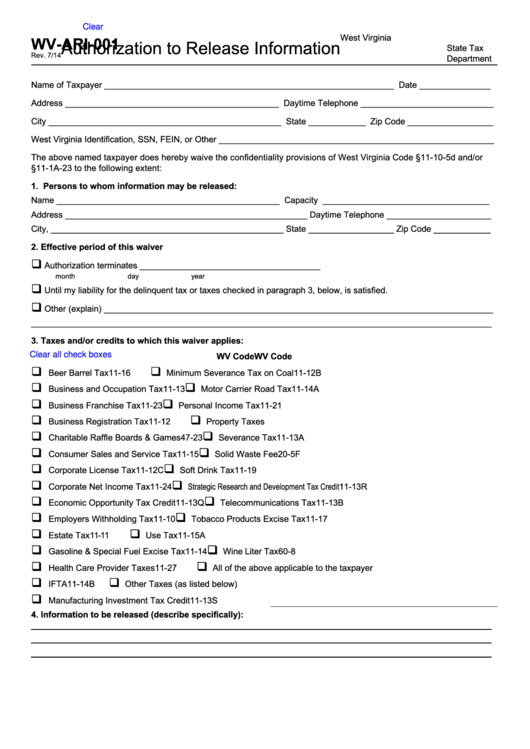

WV-ARI-001

Authorization to Release Information

State Tax

Rev. 7/14

Department

Name of Taxpayer _____________________________________________________________ Date _______________

Address _____________________________________________ Daytime Telephone ____________________________

City _________________________________________________ State ____________ Zip Code __________________

West Virginia Identification, SSN, FEIN, or Other __________________________________________________________

The above named taxpayer does hereby waive the confidentiality provisions of West Virginia Code §11-10-5d and/or

§11-1A-23 to the following extent:

1. Persons to whom information may be released:

Name _______________________________________________ Capacity ___________________________________

Address ___________________________________________________ Daytime Telephone ______________________

City, _________________________________________________ State __________________ Zip Code ____________

2. Effective period of this waiver

Authorization terminates ______________________________________

month

day

year

Until my liability for the delinquent tax or taxes checked in paragraph 3, below, is satisfied.

Other (explain) __________________________________________________________________________________

_________________________________________________________________________________________________

3. Taxes and/or credits to which this waiver applies:

WV Code

WV Code

Clear all check boxes

Beer Barrel Tax

11-16

Minimum Severance Tax on Coal

11-12B

Business and Occupation Tax

11-13

Motor Carrier Road Tax

11-14A

Business Franchise Tax

11-23

Personal Income Tax

11-21

Business Registration Tax

11-12

Property Taxes

Charitable Raffle Boards & Games

47-23

Severance Tax

11-13A

Consumer Sales and Service Tax

11-15

Solid Waste Fee

20-5F

Corporate License Tax

11-12C

Soft Drink Tax

11-19

Strategic Research and Development Tax Credit

Corporate Net Income Tax

11-24

11-13R

Economic Opportunity Tax Credit

11-13Q

Telecommunications Tax

11-13B

Employers Withholding Tax

11-10

Tobacco Products Excise Tax

11-17

Estate Tax

11-11

Use Tax

11-15A

Gasoline & Special Fuel Excise Tax

11-14

Wine Liter Tax

60-8

Health Care Provider Taxes

11-27

All of the above applicable to the taxpayer

IFTA

11-14B

Other Taxes (as listed below)

Manufacturing Investment Tax Credit

11-13S

4. Information to be released (describe specifically):

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

1

1 2

2