Employers' Annual Reconciliation Of License Fee/tax Withheld Form

ADVERTISEMENT

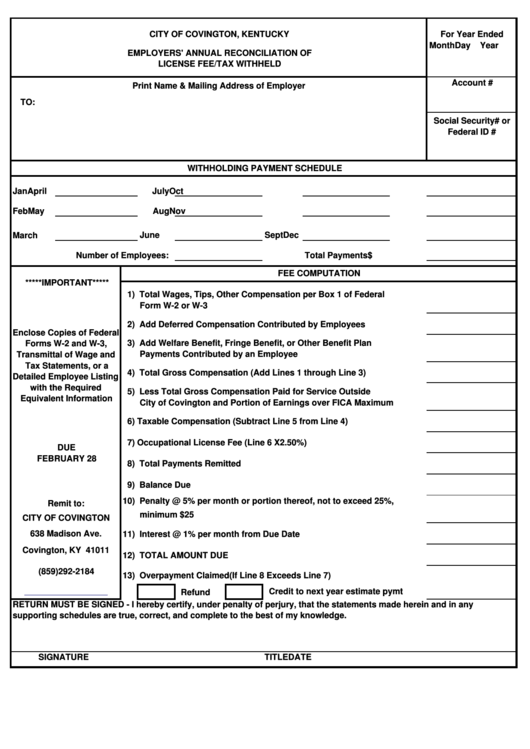

CITY OF COVINGTON, KENTUCKY

For Year Ended

Month Day

Year

EMPLOYERS' ANNUAL RECONCILIATION OF

LICENSE FEE/TAX WITHHELD

Account #

Print Name & Mailing Address of Employer

TO:

Social Security# or

Federal ID #

WITHHOLDING PAYMENT SCHEDULE

Jan

April

July

Oct

Feb

May

Aug

Nov

June

Sept

Dec

March

Number of Employees:

Total Payments

$

FEE COMPUTATION

*****IMPORTANT*****

1) Total Wages, Tips, Other Compensation per Box 1 of Federal

Form W-2 or W-3

2) Add Deferred Compensation Contributed by Employees

Enclose Copies of Federal

3) Add Welfare Benefit, Fringe Benefit, or Other Benefit Plan

Forms W-2 and W-3,

Payments Contributed by an Employee

Transmittal of Wage and

Tax Statements, or a

4) Total Gross Compensation (Add Lines 1 through Line 3)

Detailed Employee Listing

with the Required

5) Less Total Gross Compensation Paid for Service Outside

Equivalent Information

City of Covington and Portion of Earnings over FICA Maximum

6) Taxable Compensation (Subtract Line 5 from Line 4)

7) Occupational License Fee

(Line 6 X 2.50% )

DUE

FEBRUARY 28

8) Total Payments Remitted

9) Balance Due

10) Penalty @ 5% per month or portion thereof, not to exceed 25%,

Remit to:

minimum $25

CITY OF COVINGTON

638 Madison Ave.

11) Interest @ 1% per month from Due Date

Covington, KY 41011

12) TOTAL AMOUNT DUE

(859)292-2184

13) Overpayment Claimed

(If Line 8 Exceeds Line 7)

Credit to next year estimate pymt

Refund

RETURN MUST BE SIGNED - I hereby certify, under penalty of perjury, that the statements made herein and in any

supporting schedules are true, correct, and complete to the best of my knowledge.

SIGNATURE

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1